Executive Summary

The European Active Pharmaceutical Ingredients (API) market holds a strategically vital position within the global pharmaceutical ecosystem. Valued at $45.4 billion in 2024 and projected to expand to approximately $79.69 billion by 2033 with a Compound Annual Growth Rate (CAGR) of 5.9% through 2035, this sector is the fundamental ingredient for all medicines, directly impacting patient safety and drug efficacy.1 The European Medicines Agency (EMA) and national competent authorities (NCAs) are central to regulating this critical industry, ensuring adherence to stringent quality and safety standards.5

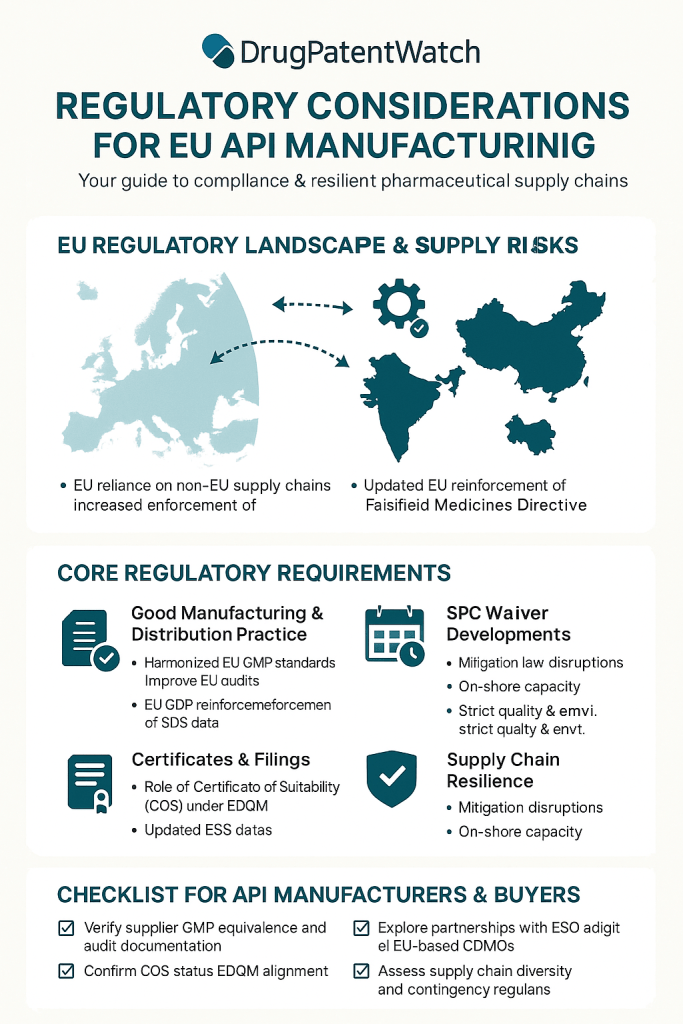

Despite its robust growth, the EU API sector navigates significant challenges. A notable vulnerability is the over-dependence on non-EU sources, with China and India collectively supplying an estimated 60-80% of APIs to Europe.7 This reliance, coupled with escalating geopolitical tensions and the inherent complexities of regulatory compliance, poses substantial risks to supply chain stability.9 Persistent hurdles for manufacturers include maintaining impeccable data integrity and consistently meeting the rigorous requirements of Good Manufacturing Practice (GMP).12

Ensuring compliance in this intricate environment demands the implementation of robust Quality Management Systems (QMS) that align with the comprehensive guidelines of EudraLex Volume 4 and ICH Q10.14 Meticulous adherence to data integrity, guided by ALCOA+ principles, is paramount, as is navigating complex import regulations, particularly those outlined in the Falsified Medicines Directive (FMD).15 To bolster supply chain resilience, strategic measures are being adopted, including diversification through dual sourcing and reshoring initiatives, along with the establishment of strategic stockpiles.17 Furthermore, digital transformation, exemplified by the introduction of Digital Product Passports (DPPs) and the increasing application of AI/ML technologies, is playing a transformative role in enhancing transparency and efficiency.20 The industry’s future is also being shaped by a growing emphasis on sustainability and green chemistry, driven by regulations such as the Ecodesign for Sustainable Products Regulation (ESPR).22

Proactive engagement with these regulatory and strategic imperatives offers a significant competitive advantage. Companies that prioritize robust compliance and embrace innovative resilience strategies can achieve enhanced market access, substantially reduce the risk of costly product recalls, strengthen their reputation, and foster continuous innovation within their operations.24

1. Introduction: Navigating the Complexities of EU API Manufacturing

The Pivotal Role of APIs in Global Pharmaceutical Supply

Active Pharmaceutical Ingredients (APIs) form the very foundation of all medicinal products, directly imparting their intended therapeutic effects. The consistent quality, purity, and reliable supply of these critical components are non-negotiable for ensuring patient safety and drug efficacy across the globe.3 Any compromise in the quality of an API, whether due to contamination, manufacturing errors, or deviations from specifications, can lead to severe consequences, including serious adverse patient effects, widespread product recalls, and even the shutdown of manufacturing facilities.4 This inherent criticality underscores the profound importance of robust manufacturing processes and stringent supply chain controls within the pharmaceutical industry, making API manufacturing a cornerstone of public health infrastructure.

Strategic Importance of the EU Market

The European Union stands as a major global pharmaceutical market, representing a significant strategic focal point for pharmaceutical companies worldwide. The European API sector alone was valued at $45.4 billion in 2024 and is projected to reach approximately $79.69 billion by 2033, demonstrating a substantial and consistent growth trajectory with a projected Compound Annual Growth Rate (CAGR) of 5.9% through 2035.1 This considerable market size and its ongoing expansion make compliance with EU regulations an indispensable factor for any global pharmaceutical company aiming to secure and maintain market access. The EU’s regulatory system, a sophisticated network coordinated by the European Medicines Agency (EMA) and supported by national competent authorities (NCAs) across its 30 European Economic Area (EEA) countries, plays a vital role in upholding the safety, quality, and efficacy of medicines available to its citizens.5

Report Objectives and Scope

This report provides a comprehensive and in-depth analysis of the complex regulatory landscape governing Active Pharmaceutical Ingredient (API) manufacturing within the European Union. Its primary objective is to detail the intricate compliance requirements that manufacturers must navigate and to articulate the strategic measures essential for building and maintaining a resilient API supply chain. The scope of this analysis will encompass a thorough examination of the prevailing regulatory frameworks, the critical role of quality management systems, the specific considerations for import and export activities, an assessment of current supply chain vulnerabilities, and a review of proactive risk mitigation strategies. Furthermore, the report will explore the increasing integration of sustainability principles and digitalization initiatives within EU API production, offering a forward-looking perspective on emerging trends and their implications for industry stakeholders.

2. The EU Regulatory Landscape for API Manufacturing

2.1 Good Manufacturing Practice (GMP) Foundations

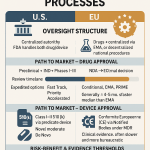

Good Manufacturing Practice (GMP) establishes the fundamental minimum standards that a pharmaceutical manufacturer must meet in its production processes. The overarching goal of GMP is to ensure that all medicines are consistently of high quality, are appropriate for their intended use, and fully comply with the requirements stipulated in their marketing authorization or clinical trial authorization.3 The European Medicines Agency (EMA) plays a pivotal role in coordinating inspections to verify compliance with these standards and actively works to harmonize GMP activities across the European Union.5

The legal framework underpinning GMP in the EU is comprehensive and multi-layered. It includes specific regulations and directives tailored to different categories of medicinal products and active substances. Key instruments include Regulation No. 1252/2014, which applies specifically to active substances for human use; Directives 2001/83/EC and (EU) 2017/1572, governing medicines for human use; Directive 91/412/EEC and Regulation (EU) 2019/6 for veterinary medicines; and Directive 2001/20/EC and Regulation (EU) 536/2014, which pertain to Investigational Medicinal Products.5 Detailed guidance and interpretation of these principles are provided in EudraLex Volume 4, often referred to as “The rules governing medicinal products in the European Union.” Part II of this volume specifically outlines the “Basic Requirements for Active Substances used as Starting Materials”.29 Furthermore, the ICH Q7 guideline provides specific GMP requirements tailored for API manufacturing.4

The regulatory oversight in the EU is a collaborative effort between the EMA and National Competent Authorities (NCAs) of the Member States. The EMA’s role involves coordinating GMP inspections, particularly for medicines authorized through the centralized procedure, and facilitating harmonization through its GMP/GDP Inspectors Working Group.5 NCAs, on the other hand, are responsible for issuing manufacturing authorizations to entities located within their respective European Economic Area (EEA) Member States. They conduct regular on-site inspections to verify ongoing compliance with EU GMP standards and perform laboratory sample controls. NCAs also serve as the primary point of contact for nationally authorized medicines and clinical trials.34 This intricate network of EMA and NCAs, supported by a pool of over 4,000 experts from across Europe, ensures a coordinated and efficient regulatory system, facilitating the exchange of crucial information on safety monitoring, clinical trials, and compliance with Good Manufacturing Practice (GMP) and Good Distribution Practice (GDP).28

Any manufacturer or importer operating within the EEA must possess a manufacturing or import authorization issued by the national competent authority of the Member State where their activities are conducted. Obtaining and maintaining this authorization is contingent upon strict adherence to EU GMP.5 Moreover, the manufacturer of the finished medicinal product bears the legal obligation to ensure that all active substances utilized in their products have been manufactured in full compliance with GMP.5 Importers of active substances destined for the EU market are also required to register their activities.5 The EudraGMDP database serves as a publicly accessible central repository for these manufacturing and import authorizations, active substance manufacturer registrations, GMP certificates, and any statements of non-compliance, thereby enhancing transparency across the entire pharmaceutical supply chain.5

A significant regulatory development is the expiration of the temporary flexibility that extended the validity of GMP certificates, which was introduced in 2021 due to the COVID-19 pandemic. This extension will no longer apply from 2025.5 This policy shift indicates a return to pre-pandemic regulatory rigor, reflecting the authorities’ confidence that National Competent Authorities (NCAs) have resumed full capacity for on-site inspections. This signals a proactive move by EU authorities to reinforce compliance standards, emphasizing that manufacturers should anticipate intensified scrutiny and ensure their GMP certificates are current and regularly renewed through on-site inspections. This also suggests a broader trend of regulatory tightening and reduced tolerance for deviations from established GMP.

The close cooperation between the EMA and NCAs, facilitated by integrated systems like IRIS and the EudraGMDP database 5, creates a highly interconnected regulatory environment. This interconnectedness means that any compliance issue identified by one authority can be rapidly disseminated across the entire EU/EEA, potentially impacting a manufacturer’s standing in multiple Member States. This structure effectively minimizes opportunities for companies to seek less stringent oversight, thereby necessitating a consistently high level of compliance across all operations, regardless of the specific Member State involved. Furthermore, this integrated approach enhances the effectiveness of mutual recognition agreements (MRAs) with third countries, as EU authorities can mutually rely on each other’s inspection outcomes.5

EU competent authorities strategically plan routine inspections based on a risk-based approach.5 This implies that manufacturers with a history of non-compliance, those operating with complex supply chains, or companies introducing novel products or manufacturing processes may face more frequent or in-depth inspections. Consequently, companies are compelled to proactively identify and mitigate their own compliance risks, as their risk profile directly influences the level and intensity of regulatory attention they receive. A robust internal quality management system and a consistent track record of compliance can therefore significantly reduce the likelihood and severity of regulatory interventions.

Table 1: Key EU GMP Legal Instruments and Guidelines for API Manufacturing

| Category | Legal Instruments/Guidelines | Scope/Description |

| Legal Instruments | Regulation (EC) No 1252/2014 | Active substances for human use |

| Directive 2001/83/EC | Medicines for human use | |

| Directive (EU) 2017/1572 | Medicines for human use | |

| Directive 91/412/EEC | Veterinary medicinal products | |

| Regulation (EU) 2019/6 | Veterinary medicinal products | |

| Directive 2001/20/EC | Investigational medicinal products | |

| Regulation (EU) 536/2014 | Investigational medicinal products | |

| Key Guidelines/Documents | EudraLex Volume 4 | Principles and guidelines of GMP in the EU, including Part II for Active Substances used as Starting Materials |

| ICH Q7 | Good Manufacturing Practice for Active Pharmaceutical Ingredients | |

| ICH Q10 | Pharmaceutical Quality System | |

| ICH Q9 | Quality Risk Management | |

| Annex 11 | Computerised Systems |

2.2 Quality Management Systems (QMS) and Data Integrity

The establishment and rigorous implementation of a Quality Management System (QMS) is a fundamental prerequisite for pharmaceutical manufacturing. A QMS provides a structured framework of processes, responsibilities, and resources meticulously designed to ensure consistent product quality and unwavering compliance with regulatory requirements.14 For pharmaceutical products, a QMS must align comprehensively with EU GMP (as detailed in EudraLex Volume 4), ICH Q10, ISO 9001, and the FDA’s 21 CFR Parts 210 and 211.14 ICH Q10, in particular, offers an internationally harmonized model for a Pharmaceutical Quality System (PQS) that extends across the entire product lifecycle, from initial development and technology transfer through commercial manufacturing to product discontinuation.14 This model is built upon three core principles: ensuring product realization, maintaining a state of control throughout processes, and fostering continual improvement.14

The core elements integral to an effective pharmaceutical QMS include robust document control and the assurance of data integrity, comprehensive change management and deviation management protocols, structured training management and defined personnel qualifications, and the implementation of effective Corrective and Preventive Action (CAPA) systems.14 Additionally, a strong QMS encompasses diligent supplier oversight and audit management, regular equipment calibration and maintenance, and periodic management reviews of product and process performance.14 An effective PQS, which integrates principles of quality risk management (as outlined in ICH Q9) and knowledge management, is crucial not only for sustainable GMP compliance but also for driving the overall robustness of the supply chain.36

Ensuring data integrity is paramount in pharmaceutical manufacturing, as it refers to the accuracy, consistency, and reliability of data throughout its entire lifecycle.15 GMP regulations place significant emphasis on strict adherence to the ALCOA+ principles: data must be Attributable, Legible, Contemporaneous, Original, Accurate, Complete, Consistent, Enduring, and Available.15 Despite this regulatory focus, common deficiencies frequently identified during EU API inspections relate to data integrity issues. These include the falsification of batch records and test results, such as rewriting documents or pretesting samples; inadequate investigation of out-of-specification (OOS) results; untimely recording of operations; the unavailability of records or the use of unbound logbooks; and a lack of sound scientific approach or controls for computerized systems, particularly concerning access levels, data manipulation, and audit trail review.12 EudraLex Volume 4, Annex 11, specifically addresses computerized systems, mandating their thorough validation, robust data security and access controls, comprehensive audit trails, and reliable data backup and recovery procedures.15

The strong emphasis on ICH Q10 and its core elements, such as CAPA, change management, and management review 14, signifies a fundamental regulatory shift from merely testing the final product to proactively embedding quality at every stage of the manufacturing process.40 This approach recognizes that quality cannot simply be “tested into” a product; rather, it must be built in from the outset. The principles of “state of control” and “continual improvement” within ICH Q10 encourage companies to adopt preventative measures, develop a deep understanding of their processes, and implement continuous monitoring. This proactive stance inherently reduces the likelihood of deviations and non-compliance, ultimately leading to enhanced product safety and efficacy.

The persistent recurrence of data integrity issues as common deficiencies in GMP inspections 12 indicates that, despite clear regulatory mandates (ALCOA+ principles, Annex 11), many manufacturers continue to struggle with ensuring the trustworthiness and reliability of their data. The increasing digitalization of pharmaceutical operations further amplifies this challenge, as electronic data systems necessitate even more stringent controls to prevent unauthorized access, alteration, or loss.4 A failure in data integrity can undermine the entire quality system, leading to severe regulatory consequences, including warning letters, import bans, or even facility shutdowns.27 Consequently, investing in robust data governance frameworks, secure IT infrastructure, and comprehensive employee training is not merely a compliance requirement but a fundamental business imperative for any pharmaceutical manufacturer.

An effective pharmaceutical quality system is explicitly recognized as a driving force behind both supply chain robustness and sustainable GMP compliance.36 This highlights a crucial causal relationship: a well-functioning internal QMS, characterized by strong processes for supplier qualification, diligent oversight of outsourced activities, and comprehensive risk management 12, directly contributes to the resilience and integrity of the entire supply chain. If a manufacturer cannot adequately ensure the quality and compliance of its raw materials or intermediate suppliers, the integrity of the final API is inherently compromised, which can lead to significant supply disruptions. Therefore, strategic investment in and rigorous maintenance of a robust QMS serves as a proactive strategy for enhancing overall supply chain resilience, extending its impact far beyond internal operational boundaries to encompass the entire network of suppliers and partners.

Table 2: Common GMP Deficiencies in EU API Inspections

| Deficiency Category | Common Issues Observed |

| Quality System Deficiencies | Insufficient oversight by quality unit (e.g., documentation control, production/lab oversight, investigation of quality events).37 |

| Inadequate or absent method validation.13 | |

| Failure to adequately investigate out-of-specification (OOS) results.13 | |

| Insufficient personnel training, including for upper management.37 | |

| Inadequate annual quality review.37 | |

| Insufficient validation of processes (e.g., recovered solvents, blending).37 | |

| Data Integrity Issues | Falsification of batch records and test results (e.g., rewriting documents, pretesting samples, deleting OOS results).12 |

| Untimely recording of operations.37 | |

| Unavailability of records or use of loose sheets.37 | |

| Lack of sound scientific approach/controls for computerized systems (e.g., access levels, data manipulation, audit trail review).37 | |

| Materials Management | Insufficient approval/management of vendors (e.g., unreliable on-site audits).37 |

| Risk of loss of traceability due to insufficient identification of containers.37 | |

| Improper storage conditions (temperature, humidity).37 | |

| Production & Equipment | Risks of contamination/cross-contamination (improper facility design, inadequate equipment cleaning/maintenance).37 |

| Lack of appropriate user requirement specifications for equipment qualification.37 | |

| Blending of batches without prior appropriate testing.37 | |

| Lack of control of solvent recovery.37 | |

| Outsourced Operations | Insufficient control over outsourced activities and supplier management.12 |

| Unclear responsibilities for interim storage or documentation control in supply chains.12 |

2.3 Import Requirements and the Falsified Medicines Directive (FMD)

To safeguard public health and prevent the entry of substandard or counterfeit medicines into its legal supply chain, the European Union has implemented stringent regulations for Active Pharmaceutical Ingredient (API) imports. Since January 2, 2013, all APIs imported for human use must have been manufactured in compliance with GMP standards that are at least equivalent to those of the EU.16 A further requirement, effective July 2, 2013, mandates that this compliance must be formally confirmed in writing by the competent authority of the exporting country.5 As an alternative, a country may be officially “white-listed” if its national GMP rules are formally assessed and deemed equivalent to those in the EU.42 The standardized Union format for the API Registration Certificate has been established and is publicly recorded in the EudraGMDP database.43 Manufacturers intending to export APIs to the EU are required to apply for this Written Confirmation, which is recognized as equivalent to WHO-GMP guidelines, and must undergo a rigorous inspection process conducted by the competent authority of their exporting country.44 This certificate typically maintains validity for a period of three years.44

The EudraGMDP database plays a crucial role in enhancing transparency and oversight within the EU pharmaceutical landscape. It serves as a publicly accessible central repository containing comprehensive information on manufacturing and import authorizations, registrations of active substance manufacturers, GMP certificates, and any official statements of non-compliance.5 Following an inspection of a manufacturing site, EU competent authorities issue either a GMP certificate or a non-compliance statement, both of which are promptly entered into this database. This system significantly promotes transparency, allowing various stakeholders to verify the compliance status of manufacturers and importers across the supply chain.

The Falsified Medicines Directive (Directive 2011/62/EU), which became applicable on January 2, 2013, constitutes a comprehensive regulatory framework specifically designed to prevent counterfeit medicines from infiltrating the legitimate distribution chain.16 Its key provisions include the mandatory application of safety features on the outer packaging of prescription medicines, consisting of a unique identifier and an anti-tampering device.16 The Directive also established the European Medicines Verification System (EMVS), a secure database that facilitates real-time verification of medicinal products throughout the EU.46 Furthermore, it introduced tougher rules governing the import of active pharmaceutical ingredients and strengthened record-keeping requirements for wholesale distributors.16 The overarching objective of the FMD is to enhance patient safety by ensuring the authenticity and traceability of medicinal products across the entire pharmaceutical supply chain.46

The requirement for Written Confirmation, while indispensable for quality assurance, has historically imposed a substantial regulatory burden on third-country manufacturers and importers. Major API-producing nations like China and India initially faced significant challenges in establishing the necessary systems and conducting the volume of inspections required to meet EU equivalence standards.42 This demand for written confirmation effectively extends EU GMP standards globally for imported APIs, serving as a powerful mechanism to ensure quality and combat falsification. However, this also creates considerable administrative and compliance pressure on non-EU manufacturers and their respective competent authorities. The initial struggles of these countries highlight the resource-intensive nature and systemic changes required, which, if not adequately addressed, could lead to potential supply disruptions. This framework also places significant responsibility on EU importers to ensure that their third-country suppliers consistently meet these rigorous standards.5

The Falsified Medicines Directive (FMD) presents a dual impact on the pharmaceutical supply chain: it significantly enhances security against counterfeits while simultaneously introducing increased operational complexity. The Directive’s provisions for serialization and verification 46 undeniably bolster supply chain integrity. However, the implementation of these measures necessitates substantial investment in new technologies, significant process changes, and robust data management systems for all stakeholders involved in the supply chain. The requirement for companies to connect to the European Medicines Verification System (EMVS) and manage unique identifiers at a granular level 46 demands sophisticated IT infrastructure and a complete overhaul of internal procedures. This inherent trade-off between enhanced security and increased operational overhead remains a key consideration for pharmaceutical companies operating within the EU market.

The EU’s strategic embrace of digitalization in regulatory oversight is evident in the use of the EMA’s IRIS system for inspections 5 and the EudraGMDP database.5 This trend is further amplified by initiatives such as the Digital Product Passport (DPP).20 Digital platforms streamline communication, automate processes, and centralize data, thereby improving overall efficiency and harmonization within the regulatory landscape.5 This shift implies that compliance is increasingly reliant on robust digital systems and impeccable data integrity. Companies that proactively invest in advanced digital tools for managing regulatory submissions, tracking products, and monitoring compliance will not only meet regulatory requirements more efficiently but also gain a distinct competitive advantage through enhanced transparency and operational control. This strategic embrace of digitalization also sets the stage for future regulatory demands that will leverage advanced digital technologies even further across the pharmaceutical value chain.

3. Strategies for Enhancing API Supply Chain Resilience in the EU

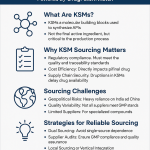

3.1 Current Vulnerabilities and Geopolitical Impacts

The European Union has explicitly acknowledged its strategic dependence on foreign inputs, particularly for Active Pharmaceutical Ingredients (APIs).17 A substantial proportion, estimated at 60-80%, of the APIs used in medicines sold in Europe originate from China and India.7 While the European Federation of Pharmaceutical Industries and Associations (EFPIA) indicates that 77% of APIs for innovative medicines produced in the EU come from within the EU itself, with only 9% from Asia, the overall reliance on China and India for

all APIs, especially generics, remains significant.47 This over-dependence on a limited number of geographical sources creates considerable supply chain vulnerabilities, as any disruption in these key regions can trigger cascading effects throughout the global pharmaceutical supply network.17

The impact of global events and escalating trade tensions on supply stability has been acutely felt. The COVID-19 pandemic, for instance, starkly exposed inherent weaknesses in critical supply chains, accelerating the EU’s pursuit of strategic autonomy in pharmaceutical production.17 Geopolitical tensions, such as the potential imposition of US tariffs on EU pharmaceutical exports, could severely disrupt transatlantic supply chains, leading to increased costs for European manufacturers and potentially affecting the availability of innovator drugs in the US market.9 A concrete example of this fragility was observed in 2022, when China’s stringent zero-Covid restrictions resulted in severe shortages of antibiotics across Europe, clearly demonstrating the precariousness of concentrated supply chains.7

Medicine shortages have emerged as a persistent and growing concern in Europe over the past decade, significantly exacerbated by disruptions within the supply chain.50 In response, the Pharmaceutical Strategy for Europe, adopted in November 2020, explicitly outlines objectives to enhance crisis preparedness and response mechanisms, ensure diversified and secure supply chains, and directly address the issue of medicine shortages.52 Further reinforcing this commitment, the Critical Medicines Alliance, established in 2024, specifically targets the over-dependence on a limited number of API suppliers and seeks to counter the decline of the EU’s domestic manufacturing sector as a means to prevent future shortages.8

The cost-resilience trade-off is an inherent aspect of global sourcing in the pharmaceutical industry. While procuring APIs from countries like China and India often yields significant cost advantages—with APIs from Chinese suppliers being approximately 40% cheaper than those produced in Europe 7—this cost-efficiency is often achieved at the expense of supply chain resilience due to geographical concentration and exposure to geopolitical risks.7 The historical focus on cost optimization led to a globalized pharmaceutical supply chain with production concentrated in regions offering lower manufacturing expenses. However, recent global crises, such as pandemics and escalating trade tensions, have unequivocally demonstrated that this efficiency-driven model introduces severe vulnerabilities. The EU is now actively grappling with the strategic dilemma of balancing the imperative of affordable healthcare with the critical need for a secure and uninterrupted supply of medicines. This implies that future sourcing decisions will increasingly integrate resilience costs, such as the potentially higher expenses associated with domestic production or investments in diversification, as a strategic necessity rather than merely a financial burden.

Supply chain disruptions are not isolated incidents; rather, they are systemic events that can cascade throughout complex, interconnected global supply chains.17 The inherent interconnectedness of global value chains means that a localized disruption—whether due to factory shutdowns, trade restrictions, or natural disasters—can trigger widespread ripple effects across the entire supply network, leading to bottlenecks and shortages in distant markets.17 This interconnectedness underscores that reactive, localized responses are insufficient to address such systemic vulnerabilities. Instead, a comprehensive, multi-faceted strategy involving robust international cooperation, proactive diversified sourcing, and integrated risk management across the entire supply chain is essential to build genuine and sustainable resilience.

The EU’s Pharmaceutical Strategy and the establishment of initiatives like the Critical Medicines Alliance 8 signify a profound policy shift towards reducing strategic dependencies and strengthening domestic and regional manufacturing capacity. The vulnerabilities exposed by recent crises have elevated supply chain security to a matter of critical public health and economic sovereignty within the EU. This strategic pivot is driving comprehensive legislative reforms and targeted investment initiatives aimed at fostering local production, actively diversifying supply sources, and enhancing emergency preparedness capabilities. This indicates a long-term commitment to reconfigure pharmaceutical supply chains, moving from a purely globalized model to one that strategically balances global efficiency with robust regional resilience.

3.2 Proactive Risk Mitigation and Diversification

To enhance supply chain resilience, the EU is actively pursuing a multi-pronged policy approach that includes increasing domestic manufacturing capacity and strategically diversifying its supplier base.17 Reshoring or nearshoring the production of Active Pharmaceutical Ingredients (APIs) to Europe is considered a key strategy to secure supply and mitigate the pervasive issue of medicine shortages.50 While this endeavor is recognized as challenging and potentially costly, requiring significant investment and adaptable regulatory frameworks, the European pharmaceutical industry has expressed a willingness to pursue it if the identified challenges are adequately addressed.50 The Critical Medicines Alliance specifically recommends strengthening the EU’s manufacturing sector and actively encouraging the expansion of API production in regions where there is currently an over-reliance on a limited number of third-country suppliers.8 Dual sourcing, a practical strategy involving the procurement of the same materials from two distinct suppliers, is being adopted to build planned redundancy and protect against disruptions affecting a single supplier or geographical region.19

In parallel with diversification efforts, the EU has unveiled a comprehensive Stockpiling Strategy as an integral part of its broader Preparedness Union Strategy. This initiative is designed to secure timely access to essential goods, including critical medical countermeasures and raw materials vital for pharmaceutical production.18 The strategy integrates existing stockpiling efforts by combining centralized EU-level reserves with contributions from individual Member States. It is further supported by public-private partnerships, ensuring efficiency, scalability, and cost-effectiveness in managing these reserves.18 Key elements of this strategy include the establishment of an EU stockpiling network to facilitate best practice sharing, strategic foresight mechanisms for identifying critical supply needs well in advance, and enhanced transport and logistics capabilities to ensure rapid distribution during crises.18

Dual sourcing, as a specific diversification strategy, is gaining significant traction within the pharmaceutical supply chain. This approach involves strategically dividing procurement for critical components between two vendors, thereby creating a vital safety net against disruptions that might affect a single supplier or region.19 While this strategy may entail potentially higher costs due to sourcing from more expensive suppliers, it demonstrably enhances resilience and can improve overall welfare by mitigating transition losses that arise from trade rigidities.53 Its effectiveness is particularly pronounced when targeted towards products that are highly exposed to shocks, positioned upstream in the supply chain, and subject to greater inherent rigidities.53

The emphasis on diversification, reshoring, and strategic stockpiling 18 signals a fundamental shift in supply chain philosophy from lean, cost-optimized “just-in-time” models to more robust, resilient “just-in-case” approaches. The vulnerabilities exposed by recent global shocks have clearly demonstrated that minimizing inventory and relying on single, low-cost suppliers, while efficient during periods of stability, creates extreme fragility during crises. The strategic move towards dual sourcing 19, building substantial inventory buffers 56, and establishing strategic stockpiles 18 reflects a conscious decision to prioritize the security of supply over pure cost efficiency. This reorientation will likely result in higher operational costs but promises greater stability and a reduced risk of critical medicine shortages, ultimately benefiting public health.

The success of EU resilience initiatives, such as the Stockpiling Strategy and the Critical Medicines Alliance, is intrinsically linked to close cooperation between public bodies (including the EMA, European Commission, and individual Member States) and the private industry.18 Supply chain resilience is a challenge too complex and resource-intensive for any single entity to manage in isolation. Public-private partnerships are therefore crucial for effective information sharing, coordinated efforts, alignment of investment priorities, and leveraging collective capabilities.18 This collaborative model is essential for accurately identifying critical medicines, comprehensively mapping existing manufacturing capacities, and implementing effective mitigation strategies, thereby ensuring a harmonized and comprehensive response to potential disruptions.

The recommendation to conduct end-to-end risk assessments across the entire product supply chain, meticulously map dependencies, and utilize scenario modeling 54 underscores the critical and foundational role of data and advanced analytics in building proactive resilience. Effective risk mitigation transcends anecdotal evidence, moving towards systematic, data-informed analysis. By leveraging digital tools for AI-driven simulations and digital twins, companies can rigorously explore how various scenarios—such as tariff hikes or policy changes—might impact their cost structures, profitability, and regulatory compliance, enabling decisions grounded in verifiable data.54 This proactive, analytical approach facilitates targeted diversification efforts, helps identify critical choke points within the supply chain, and informs strategic investments, ultimately making resilience efforts more efficient and impactful.

Table 4: Strategic Approaches for API Supply Chain Resilience

| Category | Strategic Approaches | Description & Benefits |

| Diversification & Geographical Rebalancing | Dual Sourcing | Purchasing critical APIs from two different qualified suppliers to create redundancy and mitigate single-point-of-failure risks.19 |

| Reshoring/Nearshoring | Increasing domestic or regional API manufacturing capacity within the EU/EEA to reduce dependence on distant sources and enhance supply security.8 | |

| Supplier Network Expansion | Developing strategic alliances with diverse third countries and incentivizing API production in multiple regions to spread risk and improve supply stability.8 | |

| Strategic Stockpiling & Emergency Preparedness | EU Stockpiling Strategy | Establishing centralized EU-level reserves combined with Member States’ contributions to secure access to essential goods during crises.18 |

| Critical Raw Materials Management | Ensuring secure access to foundational inputs for API production, crucial for maintaining manufacturing continuity.18 | |

| Public-Private Partnerships | Fostering collaboration between governments and industry to ensure efficient, scalable stockpiling and comprehensive preparedness.18 | |

| Digital Transformation & Visibility | Digital Product Passports (DPP) | Providing comprehensive digital information on product origin, materials, environmental impact, and traceability, enhancing transparency across value chains.20 |

| AI/ML for Supply Chain Optimization | Utilizing artificial intelligence and machine learning for predictive maintenance, enhanced process control, real-time quality monitoring, and advanced risk assessment.26 | |

| Digital Track-and-Trace Systems | Implementing technologies like 2D barcodes, RFID, and blockchain for end-to-end product traceability, crucial for anti-counterfeiting and quality assurance.58 | |

| Risk Management & Quality Integration | End-to-End Risk Assessment | Systematically mapping vulnerabilities across the entire supply chain, from raw materials to finished products, to identify critical dependencies.54 |

| Scenario Modeling | Employing digital tools to simulate the potential impacts of various disruptions (e.g., tariffs, natural disasters) on cost, profitability, and compliance.54 | |

| Robust QMS Integration | Ensuring that quality management systems, including supplier qualification, quality oversight, and CAPA processes, are seamlessly integrated throughout the entire supply chain.14 |

3.3 Digital Transformation for Supply Chain Visibility

Digital transformation is fundamentally reshaping pharmaceutical supply chains, particularly in enhancing visibility and efficiency. A significant regulatory initiative in this regard is the European Union’s new regulation, effective from 2024, which mandates that nearly all products sold in the EU must feature a Digital Product Passport (DPP).20 This initiative, integral to the Ecodesign for Sustainable Products Regulation (ESPR), aims to elevate transparency across product value chains by providing comprehensive digital information about a product’s origin, materials, environmental impact, and recommended disposal methods.20 The DPP will contain essential details such as a unique product identifier and compliance documentation, thereby enhancing supply chain management and aiding in the identification and mitigation of risks related to authenticity and environmental impact.20

The application of Artificial Intelligence (AI) and Machine Learning (AI/ML) is increasingly influencing pharmaceutical regulatory affairs and supply chain operations.21 These advanced digital technologies can optimize batch production, facilitate predictive maintenance, improve process control, and enable real-time quality monitoring within GMP environments.57 AI-driven compliance copilots are revolutionizing regulatory adherence by offering capabilities such as real-time regulatory monitoring, automated compliance assessments and auditing, intelligent training modules, and enhanced risk management through predictive analysis.26 Furthermore, digital track-and-trace systems, which utilize technologies like 2D barcodes, RFID tags, and blockchain ledgers, enable end-to-end traceability of drug products. This is crucial for preventing counterfeits and ensuring robust quality assurance beyond the factory floor.58

Navigating the implications of the EU AI Act (Regulation (EU) 2024/1689) is a critical challenge for pharmaceutical manufacturing. This landmark regulation, the world’s first comprehensive AI legislation, was implemented in August 2024 and is slated for full enforcement by August 2026.59 It categorizes AI systems based on their risk levels—minimal, limited, high, and unacceptable—with high-risk AI systems, which are frequently applicable in drug development, clinical trials, and patient data analysis, being subject to stringent requirements.59 These requirements include mandatory conformity assessments, thorough documentation, comprehensive risk management plans, ongoing post-market monitoring, and the assurance of human oversight.62 Key regulatory challenges for integrating AI/ML into GMP settings involve validating adaptive algorithms (addressing “model drift”), ensuring impeccable data integrity (adhering to ALCOA+ principles), and achieving explainability and transparency for “black-box” algorithms.57 The alignment of the AI Act with existing regulations, such as the Medical Device Regulation (MDR), also presents complexities and potential additional burdens for manufacturers.60

Digitalization serves as both a powerful enabler and a new frontier for regulatory challenges. While digital tools significantly enhance supply chain visibility, operational efficiency, and overall compliance 20, they simultaneously introduce new layers of regulatory complexity, particularly with the advent of the EU AI Act.59 The benefits of digitalization in pharmaceutical manufacturing are clear, encompassing improved data management, real-time monitoring, and automation.4 However, the EU AI Act’s risk-based approach 62 means that AI systems deployed in critical functions, such as quality control or drug development, will undergo rigorous scrutiny concerning their validation, data integrity, and explainability.57 This necessitates that companies not only adopt new technologies but also invest substantially in understanding and complying with the associated digital regulations, ensuring that their digital transformation efforts are compliant by design from the outset.

A proactive AI strategy is becoming a competitive imperative. Given the staggered implementation timelines of the EU AI Act 60, early adoption and demonstrated compliance can provide a significant competitive advantage. Companies that proactively integrate AI compliance into their core operations, focusing on the development and deployment of transparent and reliable AI systems, can build trust with regulators, investors, and end-users.26 This “first-mover” advantage in regulatory compliance can lead to faster market access for innovative products and a stronger market position, differentiating them from competitors who adopt a more cautious “watch and wait” approach. Furthermore, it allows companies to structure their AI development processes to inherently meet regulatory expectations, thereby avoiding costly retrofitting efforts later on.

Traceability emerges as a unifying thread across modern EU pharmaceutical regulation. From the Falsified Medicines Directive (FMD) to the Digital Product Passport (DPP), and further enhanced by AI/ML applications, end-to-end traceability is an increasingly granular and recurring requirement across EU pharmaceutical supply chains.20 The regulatory drive for traceability stems from multiple objectives, including combating counterfeits, ensuring patient safety, facilitating rapid product recalls, and promoting environmental sustainability. The FMD introduced unit-level serialization 46, and the DPP extends this concept to encompass comprehensive lifecycle information for products.20 AI/ML tools further augment the ability to track and trace products and their constituent components in real-time.58 This pervasive emphasis signifies that robust, integrated traceability systems are no longer optional but are fundamental prerequisites for operating within the EU market, serving as a critical enabler for both regulatory compliance and overall supply chain resilience.

4. Sustainability and Green Chemistry in EU API Production

4.1 Regulatory Drivers for Sustainable Manufacturing

The European Union’s commitment to environmental sustainability is deeply embedded in its overarching policy framework, with the European Green Deal serving as a foundational initiative aimed at transforming the EU’s economy into a sustainable model. A pivotal component of this strategy is the Ecodesign for Sustainable Products Regulation (ESPR), formally adopted in April 2025.22 The ESPR introduces a legally binding and scientifically rigorous framework for defining and measuring the environmental impact of a wide range of consumer products, including pharmaceuticals.22 Under this regulation, most products sold in the EU will be required to carry a “digital product passport” (DPP), which will provide detailed information about the product’s composition, its environmental footprint (assessed using the Product Environmental Footprint – PEF method), its recyclability, and its traceability throughout its lifecycle.20 This represents a systemic shift in market access, where compliance with scientifically defined environmental standards will increasingly become a mandatory condition for operating within the EU.22

Further reinforcing the EU’s commitment to a greener economy, the European Commission presented its Action Plan for the Chemicals Industry in July 2025. This plan aims to bolster the competitiveness and modernization of the EU chemicals sector, actively promoting investment in innovation and sustainability.64 The Action Plan addresses critical challenges such as high energy costs and intense global competition while fostering the adoption of greener manufacturing practices. Key measures include the establishment of a Critical Chemical Alliance, designed to address risks of capacity closures and supply chain dependencies within the sector, and the implementation of an Affordable Energy Action Plan to reduce energy and feedstock costs.64 The plan also seeks to boost innovation in clean chemicals through initiatives like the Industry Decarbonization Accelerator Act and the creation of EU Innovation and Substitution Hubs.64 Additionally, it reaffirms the Commission’s commitment to minimizing emissions of harmful substances, such as per- and polyfluoroalkyl substances (PFAS).64

The Ecodesign for Sustainable Products Regulation (ESPR), with its mandatory Digital Product Passport and Product Environmental Footprint (PEF) method, fundamentally redefines the market landscape by making environmental performance a non-negotiable prerequisite for market access in the EU.22 Historically, sustainability initiatives were often perceived as optional or as a component of corporate social responsibility. However, the ESPR’s legally binding framework elevates environmental performance to a core regulatory imperative, akin to traditional GMP compliance. Companies that fail to demonstrate verifiable environmental performance, as measured by the PEF method and documented in the DPP, face the concrete risk of losing market access. This regulatory shift compels pharmaceutical manufacturers to integrate sustainability directly into their core product design and manufacturing processes, moving beyond treating it as a peripheral consideration.

The EU’s concerted efforts demonstrate an integrated regulatory approach aimed at fostering a resilient and sustainable supply chain. This strategy seeks to link environmental policy seamlessly with pharmaceutical regulation, ensuring policy coherence across various legislative instruments.65 The EU recognizes that true supply chain resilience extends beyond mere quantity and availability, encompassing the environmental footprint of production processes. By integrating the objectives of the European Green Deal into pharmaceutical and chemical legislation, the EU is establishing a holistic regulatory environment. This means manufacturers must now consider environmental impact with the same rigor as product quality and safety, ensuring that efforts to secure supply do not inadvertently compromise ecological responsibility. This integrated approach is designed to build a supply chain that is both robust and environmentally sound.

The inclusion of fiscal incentives, tax measures, and the mobilization of EU funding (e.g., through Horizon Europe) within the European Commission’s Action Plan for the Chemicals Industry 64 signals a long-term commitment to supporting the transition to cleaner and more sustainable chemical production. The provision of such financial support and incentives indicates that the EU is not merely imposing new regulatory burdens but is actively cultivating an ecosystem that encourages and rewards sustainable innovation. This approach helps to mitigate the financial risks for companies investing in green technologies and processes, thereby making the transition more economically viable. It signifies a sustained commitment from the EU to drive green chemistry and sustainable manufacturing, creating substantial opportunities for companies that strategically align with these evolving priorities.

4.2 Adopting Eco-Friendly Practices

Green chemistry represents a transformative approach in Active Pharmaceutical Ingredient (API) synthesis, fundamentally emphasizing the reduction of hazardous substances, the prevention of waste generation, and the maximization of atom economy throughout the manufacturing process.23 This paradigm requires a meticulous re-evaluation of the entire production pipeline to minimize environmental harm. A significant focus within green chemistry is the replacement of traditional, often harmful, solvents with safer, more eco-friendly alternatives. This includes the increased use of water, bio-based solvents such as ethyl lactate and glycerol, and innovative solvent systems like ionic liquids and deep eutectic solvents (DES).23

The adoption of green chemistry principles is actively driving innovation across various facets of API production. Biocatalysis, for instance, involves harnessing the catalytic power of enzymes to perform chemical transformations with remarkable precision and efficiency. This approach offers a sustainable alternative to traditional chemical catalysts, which often require harsh reaction conditions and generate significant waste.23 Another significant innovation is the shift towards Continuous Manufacturing. This involves moving away from traditional batch processes to continuous flow chemistry, which not only reduces equipment size and shortens production times but also significantly improves product quality and substantially cuts energy use and solvent waste.23 Process intensification techniques, such as the use of microreactors, enable precise control over reaction parameters, enhancing efficiency and safety while simultaneously reducing environmental impact.23 Furthermore, leveraging renewable feedstocks—materials derived from biological sources like plants and algae—is opening new pathways for truly sustainable API production.23

Leading pharmaceutical companies are actively implementing these green initiatives, setting new benchmarks for the industry. AstraZeneca, for example, has set ambitious targets to achieve zero carbon emissions in its operations by 2025 and across its entire value chain by 2030.69 Sanofi is actively developing biodegradable solvents and operating some of its sites on renewable energy sources.69 GSK has adopted comprehensive sustainable packaging strategies to reduce plastic waste.69 Companies like Pfizer and Merck have redesigned their synthesis processes, significantly reducing solvent use, waste generation, and energy consumption.67 Novo Nordisk is pioneering water conservation efforts with a goal of achieving zero water waste by 2030.69 Public-private partnerships, such as the EU-funded Biocascades project, are exploring innovative enzymatic reaction cascades to develop more efficient and environmentally friendly methods for producing key drug ingredients.70 The future outlook for the industry includes an increased reliance on Artificial Intelligence (AI) for optimizing green reaction pathways and a broader adoption of circular economy models, where pharmaceutical waste is recovered and repurposed.67

Beyond mere regulatory compliance, embracing green chemistry offers substantial competitive advantages and fosters innovation. Companies that adopt eco-friendly practices not only reduce their environmental footprint but also enhance operational efficiency, ensure robust regulatory compliance, and meet the growing market demand for environmentally conscious products.23 Reduced waste generation and lower energy consumption directly translate into decreased operational costs, while improved process efficiency can lead to higher product yields.66 Furthermore, a strong commitment to sustainability significantly enhances corporate reputation and can attract environmentally conscious investors and consumers. This positions green manufacturing as a strategic differentiator that drives both economic value and environmental stewardship.

A truly sustainable pharmaceutical industry necessitates a holistic approach to environmental impact across the entire product lifecycle. This means considering not only the manufacturing process itself but also the sustainable sourcing of raw materials, the use of eco-friendly packaging, and responsible waste disposal methods.67 Regulatory measures, such as the EMA’s mandatory environmental risk assessment (ERA) for new marketing authorization applications 67 and the ESPR’s digital product passport 22, are compelling companies to adopt this comprehensive, lifecycle-oriented perspective. This ensures accountability for environmental impact at every stage of the value chain, leading to a more integrated and responsible industry.

Advanced technology serves as a crucial enabler for the successful implementation of green chemistry principles. Technologies such as Artificial Intelligence (AI), Machine Learning (ML), and continuous manufacturing are pivotal in realizing the ambitious goals of sustainable API production.40 Implementing green chemistry often requires complex process redesign and optimization. AI and ML can analyze vast datasets to identify greener synthetic routes and optimize reaction conditions, leading to significant reductions in waste and energy consumption.67 Continuous manufacturing, by its inherent design, is more resource-efficient and generates less waste compared to traditional batch processes.40 This highlights that digital transformation and sustainable manufacturing are not disparate initiatives but are mutually reinforcing, with technology providing the essential tools to achieve ambitious environmental objectives.

5. Achieving Competitive Advantage Through Compliance and Innovation

5.1 European API Market Dynamics and Outlook

The European Active Pharmaceutical Ingredients (API) market is a dynamic and growing sector, valued at $45.4 billion in 2024 and projected to reach approximately $79.69 billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 5.9% through 2035.1 This growth is driven by several key segments. Generic APIs dominated the market with a 58% revenue share in 2023, primarily propelled by the expiration of patents on branded medications.2 While innovative APIs hold a smaller share, this segment is characterized by cutting-edge research and novel formulations. In terms of synthesis type, synthetic APIs accounted for the largest revenue share (72%) in 2023, attributed to their ready availability, consistency, and cost-effectiveness.2 Conversely, biotech APIs are anticipated to exhibit the highest CAGR of 6.55% during the forecast period, fueled by substantial investments in biotechnology and biopharmaceutical sectors and the increasing demand for biologics, with monoclonal antibodies leading this growth.2 Regarding manufacturing models, the captive API segment, where APIs are produced in-house, dominated with a 53% revenue share in 2023, reflecting significant investment by major players seeking greater control over quality and supply chain. The merchant API segment, however, is projected to show the fastest growth with a 7.72% CAGR.2 From an application perspective, cardiology commanded the largest market share in 2023 (23% revenue share), while the oncology segment is projected to expand with the fastest CAGR of 7.45% due to the rising global prevalence of cancer.2

The future of EU API manufacturing is being shaped by several transformative trends. Digitalization and automation are increasingly prevalent, with a growing adoption of digital batch records, AI for quality monitoring, and predictive maintenance.4 Electronic Common Technical Documents (eCTD) and electronic submission gateways are becoming standard practice, streamlining regulatory processes and enhancing efficiency.21 The industry is also embracing continuous manufacturing and Process Analytical Technology (PAT), advanced techniques that offer improved control, efficiency, and consistent product quality.4 Concurrently, there is an increased emphasis on data integrity and cybersecurity, which are critical for ensuring product safety and efficacy in an increasingly digitalized environment.4 Finally, the adoption of green chemistry principles is a growing trend, driven by a push towards eco-friendly strategies to minimize environmental impact and enhance overall sustainability.4

The simultaneous growth of the generic API market, driven by patent expirations, and the rapid expansion of biotech APIs, fueled by significant research and development investment, presents a bifurcated yet dynamic market landscape. This dual growth trajectory means that API manufacturers must strategically position themselves to capitalize on these distinct opportunities. Companies specializing in cost-effective synthetic generic APIs can leverage the upcoming patent cliffs, while those investing in complex biotech API manufacturing can tap into the high-growth, high-value biologics market. Navigating this dual opportunity requires distinct yet equally rigorous compliance and quality strategies tailored to each segment.

The pervasive trend towards digitalization, encompassing everything from digital batch records to AI-driven quality monitoring, is no longer an optional enhancement but a critical factor for competitive success. Manual processes are increasingly inefficient and prone to errors within the highly regulated pharmaceutical environment. Digitalization offers significant advantages in terms of speed, accuracy, data integrity, and enabling real-time decision-making.4 Companies that fail to embrace digital transformation risk falling behind in operational efficiency, regulatory compliance, and responsiveness to market demands, ultimately impacting their overall market competitiveness and ability to navigate complex regulatory landscapes.

The dominance of the captive API segment underscores a strategic choice by larger pharmaceutical companies to internalize API manufacturing.2 By controlling their own API production, major players gain greater oversight over product quality, purity, and supply chain security, thereby reducing their reliance on external suppliers and mitigating risks of shortages or quality deviations.2 This backward integration, while demanding significant initial investment, offers enhanced control and resilience, which constitutes a valuable competitive advantage in a volatile global market. Conversely, smaller players may find substantial opportunities within the growing merchant API segment, particularly by focusing on specialized or niche APIs that cater to specific market demands.

Table 3: European API Market Overview and Projections (2024-2035)

| Metric | Details | Source |

| Market Size (2024) | $45.4 billion | 1 |

| Projected Market Size (2033/2035) | ~$79.69 billion by 2033 | 2 |

| CAGR (2025-2035) | 5.9% (or 5.78% by 2033) | 1 |

| Key Segments (2023 Revenue Share) | Generic API: 58% | 2 |

| Synthetic API: 72% | 2 | |

| Captive API: 53% | 2 | |

| Fastest Growing Segments (CAGR) | Merchant API: 7.72% | 2 |

| Biotech API: 6.55% | 2 | |

| Oncology Application: 7.45% | 2 | |

| Other Key Data (2023) | Cardiology Application Share: 23% | 2 |

| Prescription Segment Share: 80% | 2 | |

| OTC Segment Fastest Growth (2024-2033): 5.87% CAGR | 2 |

5.2 Compliance as a Strategic Differentiator

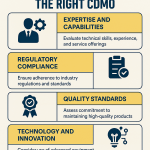

Adherence to European Union regulations, particularly Good Manufacturing Practice (GMP), offers substantial benefits that extend far beyond mere legal obligation. Robust compliance serves as a powerful strategic differentiator in the highly competitive pharmaceutical market.

One of the most significant benefits is enhanced market access. Compliance with GMP is a fundamental prerequisite for distributing products within the EU market.5 Companies that proactively ensure compliance can avoid costly delays and extensive rework during the product development and approval processes.6 Furthermore, robust compliance directly leads to a significant reduction in product recalls and minimizes the likelihood of severe enforcement actions. Strict adherence to GMP guidelines substantially lowers the risk of product recalls, which are inherently costly and can severely damage a company’s reputation.24 Conversely, non-compliance can result in severe regulatory consequences, including warning letters, import bans, consent decrees, or even the temporary or permanent shutdown of manufacturing facilities.4 Beyond these tangible benefits, consistent quality and compliance significantly improve a company’s reputation and foster trust among healthcare providers, patients, and consumers.4 Compliance with EU cybersecurity and data protection regulations, such as GDPR, NIS2, and the Cyber Resilience Act, signals a high level of responsibility and builds crucial credibility, which translates into a distinct competitive edge.71 Ultimately, companies that consistently adhere to GMP can differentiate themselves in the market by providing strong assurance of product quality and safety.24 Early investment in compliance for emerging regulations, such as the EU AI Act, can also open doors to strategic partnerships and accelerate market entry for innovative products.60

Digital transformation offers powerful tools to streamline compliance processes and enable predictive risk management. Electronic Quality Management Systems (eQMS) are instrumental in streamlining QMS processes, enhancing traceability, and ensuring consistent compliance.14 AI-powered compliance copilots are revolutionizing regulatory adherence by providing real-time regulatory monitoring, automating compliance assessments and auditing, facilitating intelligent training, and enabling enhanced risk management through predictive analysis.26 These intelligent systems can analyze vast datasets to identify patterns indicative of regulatory vulnerabilities before they materialize, allowing for proactive intervention.26 Automated proofreading tools swiftly detect errors, ensure consistency in documentation, and significantly streamline the proofreading process, which is vital for maintaining accuracy, quality, and regulatory adherence.25 Furthermore, Regulatory Information Management (RIM) systems centralize regulatory data, providing a single source of truth that streamlines regulatory processes and supports data consistency across an organization.21

Numerous case studies illustrate the tangible benefits of successful compliance strategies. Companies have achieved EU product approval following rigorous pre-approval inspections (PAI) and audits conducted by the EMA, often leveraging support from external consultants who provide mock inspections and gap assessments.72 Specific remediation projects addressing identified GMP compliance gaps and weaknesses have consistently led to positive inspection outcomes, demonstrating the effectiveness of proactive intervention.73 The implementation of robust quality management systems and continuous, comprehensive staff training are consistently identified as key practices for preventing non-compliance incidents.27

Robust compliance, rather than being merely a cost center, actively functions as a value driver within the pharmaceutical industry. Beyond simply avoiding penalties, a strong compliance posture directly contributes to market differentiation, cultivates customer loyalty, and enhances overall business resilience.24 In a highly regulated sector like pharmaceuticals, compliance is often perceived as a burdensome expense. However, evidence demonstrates that a strong commitment to compliance translates into tangible competitive advantages. It builds essential trust with both regulators and customers, significantly reduces the financial and reputational risks associated with product recalls or enforcement actions, and can even accelerate market access for new products. This perspective transforms compliance from a necessary evil into a strategic investment that yields substantial returns.

The adoption of AI-driven tools for real-time monitoring, automated assessments, and predictive risk management is transforming compliance from a retrospective, reactive process into a continuous, forward-looking one. Traditional compliance often relies on periodic audits and reactive responses to identified deviations. However, digital tools, particularly AI-powered solutions, enable companies to continuously track regulatory updates, cross-reference internal policies against current requirements, identify inconsistencies, and even predict potential compliance risks before they materialize.26 This proactive capability minimizes human error, significantly improves operational efficiency, and allows for timely corrective actions, thereby substantially reducing the likelihood of major non-compliance events and providing compliant companies with a distinct competitive edge.

The emphasis on robust Quality Management Systems (QMS), impeccable data integrity, and advanced digital tools underscores the critical need for a holistic approach to quality and compliance throughout the entire product lifecycle. Compliance is not a standalone function or department; rather, it must be an intrinsic part of every stage of the pharmaceutical product lifecycle. From the initial design and development of APIs (guided by ICH Q7 and Q10) to their manufacturing, distribution, and post-market monitoring (pharmacovigilance), quality and regulatory adherence must be deeply embedded. The strategic use of integrated QMS and digital systems facilitates this end-to-end control, ensuring that all processes, data, and personnel consistently contribute to maintaining product quality and achieving regulatory alignment. This comprehensive integration is a defining characteristic of highly competitive pharmaceutical companies operating in the EU market.

6. Conclusion and Forward-Looking Recommendations

The European Union’s Active Pharmaceutical Ingredient (API) manufacturing landscape is characterized by a complex interplay of stringent regulatory requirements and an increasing imperative for supply chain resilience. Good Manufacturing Practice (GMP) and rigorous import controls are continuously evolving, driven by the overarching goals of ensuring product quality and safeguarding patient safety. Concurrently, the sector faces escalating pressures to enhance supply chain resilience in response to geopolitical shifts, global disruptions, and an acknowledged over-reliance on concentrated non-EU sources. In this dynamic environment, digital transformation and sustainability are no longer nascent trends but are rapidly becoming integrated regulatory imperatives that demand proactive and strategic engagement from all stakeholders.

To navigate these complexities and build truly resilient and sustainable supply chains, several actionable recommendations emerge for EU API manufacturers:

- Proactive Compliance and Quality Culture: Manufacturers must implement and continuously improve a robust Quality Management System (QMS) that is fully aligned with EudraLex Volume 4 and ICH Q10. This QMS should extend its oversight across the entire supply chain, encompassing all suppliers and outsourced activities. Prioritizing data integrity, strictly adhering to ALCOA+ principles, and investing in secure, validated computerized systems are critical to meet Annex 11 requirements and prevent common deficiencies observed during inspections.

- Strategic Supply Chain Diversification: It is essential to conduct comprehensive, data-driven risk assessments of the entire supply chain to identify vulnerabilities and single points of failure. Companies should implement robust diversification strategies, such as dual sourcing for critical APIs, and actively explore opportunities for reshoring or nearshoring production within the EU/EEA, leveraging available public-private partnerships and incentives. Building strategic inventory buffers is crucial to transition from a “just-in-time” to a more resilient “just-in-case” supply model.

- Embrace Digital Transformation with Compliance in Mind: Investment in digital tools is paramount for enhanced supply chain visibility, including Digital Product Passports and advanced track-and-trace systems. Digitalization should also streamline regulatory processes through the adoption of AI-powered compliance copilots and Regulatory Information Management (RIM) systems. Companies must develop a clear strategy for navigating the EU AI Act, ensuring that all AI/ML applications are compliant by design, incorporating robust validation, data integrity, and explainability mechanisms.

- Integrate Sustainability as a Core Strategy: Proactive adoption of green chemistry principles in API synthesis is vital, focusing on waste reduction, the use of safer solvents, and energy-efficient processes like continuous manufacturing. Alignment with evolving EU sustainability regulations, such as the ESPR and the Chemicals Action Plan, is necessary. Manufacturers should leverage available funding and incentives to drive eco-friendly innovations, recognizing that environmental performance is increasingly a prerequisite for market access.

The EU pharmaceutical regulatory landscape is in a period of significant reform and transformation. The explicit warnings from CEOs of the European Federation of Pharmaceutical Industries and Associations (EFPIA) highlight a critical juncture for EU pharmaceutical policy. These leaders have issued a stark warning that unless Europe delivers “rapid, radical policy change,” pharmaceutical research, development, and manufacturing are increasingly likely to be directed towards the US.65 They emphasize that the US currently leads Europe across key investor metrics, including capital availability, intellectual property protection, speed of approval, and rewards for innovation.65 This sentiment is further supported by observations that US tariff uncertainty could prompt European companies to explore alternative markets, such as those in Pan-Asia.56

The pharmaceutical industry is highly mobile and capital-intensive, with investment decisions heavily influenced by regulatory predictability, intellectual property protection, and market attractiveness. Current EU pharmaceutical legislation proposals, particularly those perceived as potentially weakening intellectual property rights 74, are creating disincentives for investment within the EU. The vocal concerns expressed by the industry suggest that without significant policy adjustments, the EU’s ambition for strategic autonomy in medicines may be undermined by a potential exodus of pharmaceutical research and development and manufacturing capabilities. This presents a direct challenge to the EU’s long-term health security and economic competitiveness.

Geopolitical tensions and the persistent threat of tariffs are accelerating a broader trend towards regionalized supply chains and active diversification, moving away from an over-reliance on single, distant suppliers.10 Recent experiences with global supply chain disruptions have compelled a fundamental re-evaluation of global sourcing strategies. While costly and time-consuming, companies are increasingly prioritizing resilience over pure cost efficiency, leading to strategic investments in localized production, dual sourcing, and the formation of strategic alliances.54 This indicates a fundamental, long-term shift in supply chain architecture, where geographical proximity and redundancy will gain increasing prominence within risk management frameworks.

The ability to swiftly adapt to evolving regulatory frameworks, particularly those pertaining to new technologies like Artificial Intelligence and sustainability, will define future market leaders. The pharmaceutical regulatory landscape is becoming increasingly dynamic, with new regulations such as the EU AI Act and the Ecodesign for Sustainable Products Regulation (ESPR) coming into full effect.22 Companies that can anticipate these changes, integrate compliance strategies directly into their research and development and commercialization plans, and leverage new technologies for compliance management (e.g., AI copilots) will gain a significant competitive advantage. This agility in regulatory adaptation will enable faster market access for innovative therapies and reinforce trust among all stakeholders.

Finally, industry leaders consistently emphasize the critical need for stronger public-private collaboration to effectively tackle complex manufacturing challenges and reinforce Europe’s position as a stable and innovative hub.56 Addressing multifaceted issues such as medicine shortages, ensuring robust supply chain resilience, and navigating the green transition requires concerted efforts that extend beyond individual company initiatives. Collaborative strategies, including sharing infrastructure and jointly addressing pre-competitive manufacturing challenges between public bodies and private companies, can build significantly greater operational resilience and adaptability. This partnership model is crucial for fostering innovation and ensuring consistent patient access to critical therapies amidst an increasingly volatile geopolitical and policy landscape.

Works cited

- Active Pharmaceutical Ingredients in Europe: A Comprehensive 2025 Market Analysis, accessed July 26, 2025, https://api.omrglobal.com/active-pharmaceutical-ingredients-in-europe-a-comprehensive-2025-market-analysis/

- Europe Active Pharmaceutical Ingredients (API) Market Size, Share, Report 2024-2033, accessed July 26, 2025, https://www.visionresearchreports.com/europe-active-pharmaceutical-ingredients-api-market/40283

- GMP for APIs – TBD Pharmatech, accessed July 26, 2025, https://tbdpharmatech.com/resources/gmp-for-apis/

- GMP for Active Pharmaceutical Ingredients – Khawahish Lifesciences, accessed July 26, 2025, https://khawahishlifesciences.com/gmp-for-active-pharmaceutical-ingredients/

- Good manufacturing practice | European Medicines Agency (EMA), accessed July 26, 2025, https://www.ema.europa.eu/en/human-regulatory-overview/research-development/compliance-research-development/good-manufacturing-practice

- Navigating EMA Guidelines, accessed July 26, 2025, https://www.numberanalytics.com/blog/ultimate-guide-ema-guidelines-pharmaceutical-law-regulation

- Europe’s increasing reliance on China for critical drugs + Foreign investment + China-Africa | Merics, accessed July 26, 2025, https://merics.org/en/merics-briefs/europes-increasing-reliance-china-critical-drugs-foreign-investment-china-africa

- Strategic Report published by the Critical Medicines Alliance – ECA …, accessed July 26, 2025, https://www.gmp-compliance.org/gmp-news/strategic-report-published-by-the-critical-medicines-alliance

- European Auto & Pharma Stocks: Navigating US Tariffs with Resilient Supply Chains, accessed July 26, 2025, https://www.ainvest.com/news/european-auto-pharma-stocks-navigating-tariffs-resilient-supply-chains-2507/

- EU/US Trade: Takeaways for Companies Amid Turbulent Tariff Policy – Morgan Lewis, accessed July 26, 2025, https://www.morganlewis.com/pubs/2025/07/eu-us-trade-takeaways-for-companies-amid-turbulent-tariff-policy

- What Pharma Manufacturers Need to Know About US Trade Policy Changes, accessed July 26, 2025, https://www.pharmtech.com/view/what-pharma-manufacturers-need-to-know-about-us-trade-policy-changes

- QUALITY MANAGEMENT AND DATA INTEGRITY IN API PRODUCTION – GMP Journal, accessed July 26, 2025, https://www.gmp-journal.com/current-articles/details/quality-management-and-data-integrity-in-api-production.html

- Deficiencies Found in API Inspections – Pharmaceutical Technology, accessed July 26, 2025, https://www.pharmtech.com/view/deficiencies-found-api-inspections

- Pharmaceutical Quality Management System (QMS) – SimplerQMS, accessed July 26, 2025, https://simplerqms.com/pharmaceutical-quality-management-system/

- EU Annex 11 Explained: Ensuring Data Integrity in Pharmaceuticals – Zamann Pharma Support GmbH, accessed July 26, 2025, https://zamann-pharma.com/2025/04/14/eu-annex-11-explained-ensuring-data-integrity-in-pharmaceuticals/

- Falsified medicines – Public Health – European Commission, accessed July 26, 2025, https://health.ec.europa.eu/medicinal-products/falsified-medicines_en