In the high-stakes world of pharmaceutical innovation, the journey from a breakthrough molecule in a petri dish to a market-leading therapeutic is a marathon of staggering complexity. It’s a path paved with immense scientific challenges, rigorous regulatory hurdles, and breathtaking financial investment. The reward at the end of this arduous race? A patent. This legal instrument grants a period of market exclusivity, a temporary monopoly designed to allow innovators to recoup their R&D costs and profit from their discovery. But here lies a crucial, often underestimated, truth: the patent itself is not the finish line. It is the starting gun.

The value of a patented drug is not inherent in its chemical structure or its clinical trial data alone. Its true value is realized only through a masterfully executed marketing strategy that begins years before launch and extends far beyond the patent’s expiration. How do you transform a scientific asset into a commercial powerhouse? How do you build an unbreachable fortress around your brand, ensuring that every day of that precious exclusivity is maximized to its fullest potential? This isn’t just about advertising; it’s about orchestrating a complex symphony of science, data, communication, and strategic foresight. It’s about turning patent protection into market domination.

This in-depth guide is for the pharmaceutical leaders, brand managers, and strategic planners who understand that effective marketing is the force multiplier for patent exclusivity. We will dissect the strategies, from pre-launch market shaping to post-launch life cycle dominance, that separate the blockbusters from the forgotten molecules. We will explore how to weave your intellectual property (IP) strategy into the very fabric of your marketing narrative, creating a value proposition so compelling that it reshapes clinical practice and captures enduring market share.

The High-Stakes Overture: Why Your Drug’s Marketing Strategy is as Crucial as its Science

The pharmaceutical industry operates under a unique and unforgiving business model. The upfront investment is astronomical. The Tufts Center for the Study of Drug Development pegs the cost of bringing a new drug to market at an estimated $2.6 billion, a figure that includes the cost of the many failures that precede a single success [1]. This colossal bet is placed on the hope of a period of market exclusivity, during which the innovator can price the product to reflect its value and generate revenue. But this period is finite, and the clock is always ticking.

The Patent Cliff: A Looming Reality

The term “patent cliff” is more than just industry jargon; it’s a specter that haunts every pharmaceutical boardroom. It describes the dramatic and rapid loss of revenue—often 80-90%—that occurs when a blockbuster drug’s primary patent expires and generic competitors flood the market. The story of Pfizer’s Lipitor is the canonical example. At its peak, it was the best-selling drug in the history of the pharmaceutical industry, generating over $13 billion in annual sales. The day it lost patent protection in 2011, its revenue trajectory began a precipitous fall from which it would never recover [2].

This reality fundamentally shapes the imperative of pharmaceutical marketing. The goal is not just to launch a drug successfully but to build a brand and a market position so robust that it maximizes revenue before the cliff and creates a “long tail” of value after it. A brilliant marketing strategy can effectively extend the functional life of the brand, even when the legal exclusivity has waned. It does this by building deep loyalty, integrating the drug into clinical guidelines, and proving its value beyond any doubt.

Beyond the Molecule: Defining Value in a Crowded Market

In today’s therapeutic landscapes, it’s rare for a new drug to launch into a vacuum. More often, it enters a market with existing treatments, each with its own established physician base and patient population. In this environment, a new patent doesn’t automatically guarantee success. The market asks a simple but brutal question: “Why should I change?”

Your marketing strategy is your answer to that question. It’s the engine that translates complex clinical data—hazard ratios, p-values, confidence intervals—into a clear, compelling, and actionable narrative. What is the unique value proposition?

- Is it superior efficacy on a key endpoint?

- Is it a significantly better safety or tolerability profile?

- Is it a more convenient dosing regimen that improves adherence?

- Does it address a previously unmet need in a specific sub-population of patients?

Without a powerful marketing strategy to define and communicate this value, even a scientifically superior molecule can fail to achieve its commercial potential. It risks becoming, in essence, the best-kept secret in medicine.

The Symbiotic Relationship Between Patent Exclusivity and Marketing ROI

Think of your patent exclusivity period as a finite resource, like a reservoir of water in a desert. Every marketing dollar you spend during this period is an investment in drawing as much value from that reservoir as possible. The return on investment (ROI) for marketing activities is dramatically higher during the exclusivity period than it is post-LOE (Loss of Exclusivity).

During exclusivity, your marketing efforts are aimed at:

- Accelerating Adoption: Rapidly moving the drug from launch to peak sales to maximize the time spent at maximum revenue.

- Expanding the Market: Educating the market about the disease state itself to identify more undiagnosed or undertreated patients.

- Building the Brand “Moat”: Creating such strong brand equity and physician loyalty that it becomes difficult for future competitors (both branded and generic) to make inroads.

A well-funded, brilliantly executed marketing plan during the on-patent years is not an expense; it is a direct investment in maximizing the once-in-a-lifetime opportunity your patent provides. It ensures that when the generics do arrive, they are competing against not just a molecule, but a trusted, deeply entrenched brand.

Laying the Foundation: Pre-Launch Strategies to Prime the Market

The success of a drug launch is often determined years before the first prescription is ever written. The pre-launch phase is a period of intense strategic activity, where the commercial team works in parallel with the clinical and regulatory teams to shape the market, define the narrative, and clear the path for access. This is not about premature promotion; it’s about sophisticated, compliant preparation. To launch a drug into an unprepared market is like trying to land a plane on a runway that hasn’t been built yet.

Phase 0 Marketing: Building the Narrative Before the NDA

Long before the New Drug Application (NDA) is submitted to the FDA, the “Phase 0” marketing work must begin. This is the unbranded, educational phase focused on preparing the soil so that the seeds of your brand can later flourish.

Disease State Education: Creating a “Problem-Aware” Audience

You cannot sell a solution to someone who doesn’t recognize they have a problem. Disease state education is the foundational activity of pre-launch marketing. The goal is to raise awareness among healthcare professionals (HCPs) and sometimes even the public about the targeted condition, focusing on:

- The Unmet Need: Highlighting the limitations, side effects, or gaps in efficacy of current standard-of-care treatments.

- The Burden of Illness: Communicating the true impact of the disease on patients’ lives, caregiver burden, and the healthcare system (e.g., hospitalizations, lost productivity).

- Emerging Science: Discussing new understandings of the disease’s pathophysiology that create a rationale for a new mechanism of action (coincidentally, the one your drug employs).

This is done through unbranded websites, continuing medical education (CME) programs, publications in scientific journals, and presentations at medical congresses. It’s a subtle but powerful way of framing the clinical conversation, so that when your drug launches, the market is already primed to understand its significance. For example, before the launch of PCSK9 inhibitors for hypercholesterolemia, a massive educational effort was undertaken to re-emphasize the risks of high LDL-C and the limitations of statin therapy for many high-risk patients.

KOL Identification and Engagement: Building Your Scientific Choir

Key Opinion Leaders (KOLs)—respected academic physicians, researchers, and heads of major clinical departments—are the trusted voices within the medical community. Their opinions shape clinical practice, influence treatment guidelines, and are sought after by their peers. Engaging with KOLs early is paramount.

This process, managed by Medical Science Liaisons (MSLs), is a dialogue, not a monologue. MSLs, who typically have advanced scientific degrees (PharmD, PhD, MD), engage KOLs to:

- Gather Insights: Understand their perspective on the unmet needs, their experience with current therapies, and their reaction to your emerging clinical data. This feedback is invaluable for refining your clinical development and marketing strategy.

- Provide Education: Share top-level, non-promotional data from your clinical trial program as it becomes available and is publicly disclosed (e.g., at a congress).

- Identify Advocates: Nurture relationships with those experts who genuinely believe in the science behind your product. These KOLs will become your future speakers, authors, and advisory board members. They are the credible, third-party validators of your drug’s value.

Building this “scientific choir” ensures that when your brand launches, its message is amplified and legitimized by the most respected voices in the field.

Early Payer Conversations: Decoding the Access Labyrinth

A drug that physicians want to prescribe but patients can’t get is a commercial failure. Market access—ensuring your drug is on insurance formularies and affordable for patients—is a battle won long before launch. Payers (insurance companies, pharmacy benefit managers (PBMs)) are the gatekeepers.

Early, pre-approval information exchange (PIE) with payers is now a compliant pathway in the U.S. [3]. This allows manufacturers to share certain information about a drug before it’s approved, including clinical data and economic models. These conversations are critical for:

- Understanding Payer Priorities: What evidence do they need to see to grant favorable formulary access? Are they focused on total cost of care, hospitalization rates, or specific clinical endpoints?

- Informing Your HEOR Strategy: Health Economics and Outcomes Research (HEOR) is the discipline of generating data that demonstrates the economic value of your drug. Early payer feedback helps you design the right HEOR studies to prove your drug is not just a cost, but a sound investment for the healthcare system.

- Forecasting and Pricing: These early discussions provide crucial inputs for your pricing and reimbursement strategy, helping you model potential formulary tiers, prior authorizations, and patient out-of-pocket costs.

Ignoring payers until after launch is a recipe for disaster, potentially leading to months of restricted access while you scramble to provide the evidence they needed all along.

The Target Product Profile (TPP) as a Marketing Blueprint

The Target Product Profile (TPP) is a dynamic internal document that outlines the desired characteristics of your drug. It starts as a “wish list” early in development and is refined over time as clinical data becomes available. While it’s a regulatory and clinical tool, it is also a foundational marketing document.

Aligning Clinical Endpoints with Market Needs

The TPP forces a crucial alignment between what you can measure in a clinical trial and what the market actually values. It’s the job of the marketing team to champion the voice of the customer in TPP discussions. For example, a clinical trial might be designed to show a statistically significant improvement on a complex, composite primary endpoint. But marketing’s input might be: “That’s great for the FDA, but doctors and patients will really care about the ‘time to symptom relief’ secondary endpoint. We need to power the study to win on that.” This ensures your clinical trial isn’t just a scientific success, but a commercial one, generating the specific claims you need to differentiate your product.

From Efficacy to Effectiveness: Translating Data into a Compelling Story

The TPP helps you begin crafting the core story of your brand. It moves beyond just listing data points and starts to build a narrative. The TPP should contain sections for:

- Target Indication and Patient Population: Who are we trying to treat?

- Key Efficacy Claims: What will we be able to say about how well it works?

- Key Safety and Tolerability Claims: How will we position its safety profile?

- Dosing and Administration: How will its convenience compare to competitors?

- Competitive Differentiation: On what specific attributes will we be better, different, and special?

This document becomes the strategic blueprint for all future marketing materials, sales training, and communication efforts. It is the constitution of your brand.

Leveraging Competitive Intelligence and Patent Data

You cannot win a game without knowing the other players and the layout of the field. Competitive intelligence (CI) is the systematic collection and analysis of information about your competitors and the market environment. A critical and often underutilized component of CI is patent intelligence.

Mapping the Patent Landscape with Tools like DrugPatentWatch

Before you can effectively market your own patented drug, you must have an encyclopedic knowledge of the entire patent ecosystem in your therapeutic area. This goes far beyond just knowing your competitors’ primary compound patents. You need to understand:

- Formulation Patents: Do they have patents on extended-release versions or new delivery methods that could extend their product’s life?

- Method-of-Use Patents: Have they patented the use of their drug in a specific, valuable patient sub-population?

- Combination Patents: Are they patenting combinations of their drug with other agents?

- Patent Expiration Dates: When does their key patent and data exclusivity really expire?

This is where specialized services become indispensable. Platforms like DrugPatentWatch provide comprehensive databases and analytics that track patents, exclusivity periods, litigation, and generic filings. By using such a service, a strategic marketing team can gain a significant advantage. For example, knowing a competitor’s formulation patent is weak and likely to be challenged can inform your long-term messaging strategy, positioning your product’s convenience as a more durable advantage. This intelligence transforms your IP from a purely legal concern into a proactive marketing weapon.

Identifying White Space and Potential Threats

A thorough patent landscape analysis, combined with clinical and commercial intelligence, helps you identify both opportunities and threats.

- White Space: Are there unmet needs or patient segments that are not adequately covered by existing products or their patent filings? This could be a prime target for your drug’s life cycle management plan.

- Potential Threats: Is a competitor developing a drug with a similar mechanism of action? What does their patent filing tell you about their timeline and potential claims? Are generics likely to launch “at risk” (i.e., before patent litigation is fully resolved)?

This foresight allows you to build preemptive strategies. If you know a competitor is coming, you can start building a “first-mover advantage” narrative and focus on generating loyalty. If you anticipate aggressive generic entry, you can develop a more robust end-of-life strategy. In the chess game of pharma marketing, patent intelligence allows you to see several moves ahead.

The Grand Launch: Orchestrating a Flawless Market Entry

The day of regulatory approval is the culmination of a decade or more of work. But for the commercial team, it’s Day One. The launch phase is a period of maximum intensity and investment, typically lasting 12-18 months post-approval. A drug’s sales trajectory in its first six months is highly predictive of its ultimate peak sales. A slow start is incredibly difficult to overcome. Orchestrating a flawless launch requires perfect synchronization of messaging, channel deployment, and access strategy. It’s the moment the symphony you’ve been composing finally plays for the world.

Crafting the Core Message: Your Value Proposition Unveiled

All the pre-launch research, KOL engagement, and strategic planning now crystallizes into a single, powerful core message. This is your brand’s elevator pitch—the concise, compelling, and consistent story you will tell the world. This value proposition must be differentiated, defensible, and easily digestible.

The Three Pillars: Efficacy, Safety, and Differentiators

Your core message will almost always be built upon three pillars:

- Efficacy: This is the foundation. How well does the drug work? Your claims must be directly supported by the data in your approved label. The key is to select the most impactful and differentiating data points. Is it the primary endpoint? A key secondary endpoint? The speed of onset? The durability of the effect?

- Safety & Tolerability: This is the crucial counterpoint to efficacy. A drug’s safety profile can be just as important as its efficacy, particularly in chronic diseases. The goal is to present the safety data transparently and in context, addressing potential concerns head-on while highlighting any advantages over competitors (e.g., fewer drug-drug interactions, a lower incidence of a particularly bothersome side effect).

- The “Something Else” – Differentiators: This is what often seals the deal. Beyond efficacy and safety, what makes your drug unique?

- Convenience: A once-daily oral pill vs. a weekly injection.

- Mechanism of Action (MOA): A novel MOA can be a powerful differentiator, especially if it addresses the underlying cause of the disease in a new way.

- Patient-Reported Outcomes (PROs): Data showing the drug doesn’t just improve lab values but makes patients feel better can be incredibly powerful.

- Targeted Population: Efficacy in a specific, hard-to-treat patient group.

The art is in weaving these three pillars into a memorable and repeatable narrative that resonates with your target audience.

Tailoring Messages for Different Stakeholders (HCPs, Payers, Patients)

While the core value proposition remains consistent, the way it is framed and the evidence used to support it must be tailored to each specific audience.

- For Healthcare Professionals (HCPs): The message is clinical and data-driven. They want to see the Kaplan-Meier curves, the hazard ratios, and the subgroup analyses. They care about how your drug fits into their existing treatment algorithm and how it compares to the standard of care. The language is precise and scientific.

- For Payers: The message is economic and evidence-based. They are less interested in the MOA and more interested in the value. Your message to them will be supported by HEOR data, budget impact models, and evidence that your drug can reduce downstream costs like hospitalizations or emergency room visits. The language is about cost-effectiveness and population health management.

- For Patients: The message is emotional and benefit-oriented. Patients want to know, “What will this do for me?” The language is simple, clear, and focuses on the tangible benefits to their quality of life. Will it reduce my pain? Will it let me play with my grandkids again? Patient-facing marketing (Direct-to-Consumer, or DTC, where permitted) must be empowering and hopeful, while always maintaining the required fair balance with risk information.

A failure to tailor the message is a common launch pitfall. A message that resonates with a top research physician will likely fall flat with a managed care executive, and vice versa.

The Multi-Channel Marketing Mix: Reaching Your Audience Where They Are

In the modern era, you can no longer simply rely on a large sales force to carry your message. A successful launch requires an integrated, multi-channel approach that surrounds your stakeholders with a consistent message delivered through their preferred channels.

Digital Dominance: The Rise of Medico-Marketing Online

The digital transformation of healthcare has accelerated dramatically. A robust digital strategy is no longer optional.

- HCP Portals: Branded websites for physicians that provide deep clinical data, on-demand webcasts from KOLs, prescribing information, and resources for their practice.

- Non-Personal Promotion: Targeted email campaigns, banner advertising on medical news sites, and virtual “e-detailing” that can supplement or even replace some traditional sales calls.

- Social Media: Compliant use of platforms like LinkedIn and Twitter (now X) for disseminating scientific data from congresses, sharing corporate news, and engaging in broader health policy discussions.

- Search Engine Optimization (SEO): Ensuring that when an HCP or patient searches for information about their condition, your branded and unbranded resources are highly visible.

The Enduring Power of the Sales Representative

Despite the digital revolution, the face-to-face interaction provided by a well-trained, professional sales representative remains a cornerstone of pharmaceutical marketing, particularly for specialist-driven products. The role of the rep has evolved from a “walking brochure” to a strategic relationship manager. Today’s reps must be:

- Clinically Astute: Capable of having a sophisticated scientific discussion with physicians.

- Business Savvy: Able to discuss local reimbursement issues and help offices navigate access hurdles.

- Orchestrators: Connecting physicians with other resources from the company, such as MSLs or patient support programs.

The launch sales force must be trained to perfection on the core message, objection handling, and the competitive landscape. Their initial calls set the tone for the brand for years to come.

Peer-to-Peer Education and Medical Science Liaisons (MSLs)

Physicians trust other physicians. Peer-to-peer programming is one of the most effective ways to drive adoption. This includes:

- Speaker Programs: KOLs and respected community physicians are trained to deliver presentations on the disease state and the clinical data behind your drug to their peers, often in small group settings like a dinner program.

- Medical Congresses: A major medical meeting is a critical launch tactic. It’s an opportunity to present your pivotal data to thousands of physicians, host symposia, and have your MSL team engage with experts.

- Medical Science Liaisons (MSLs): The MSL role continues to be crucial post-launch. They are the scientific resource for physicians, able to answer deep, off-label questions that the sales team cannot. They maintain the relationships with KOLs and gather real-world insights that are fed back to the brand team.

Pricing and Reimbursement: The Art and Science of Access

You can have the best drug in the world and the most brilliant marketing campaign, but if it’s not affordable or accessible, it will fail. The pricing decision is one of the most critical and scrutinized decisions a company makes.

“Innovation is not just about discovering a new molecule. It’s about ensuring the patients who need that molecule can actually get it. In today’s environment, your market access strategy is as vital as your clinical development strategy. Price, evidence, and access are an inseparable triumvirate.” — IQVIA Institute for Human Data Science Report, 2023 [4].

Value-Based Pricing vs. Cost-Plus Models

The old model of “cost-plus” pricing (calculating R&D costs and adding a margin) is largely obsolete. Today, pricing must be anchored in value. Value-based pricing seeks to set a price commensurate with the clinical and economic benefit the drug delivers to patients and the healthcare system. This requires a robust HEOR dossier demonstrating:

- Reductions in hospitalizations or other healthcare resource utilization.

- Improved productivity or quality of life.

- Superiority over the existing standard of care on measures that payers care about.

Some companies are even experimenting with value-based contracts, where the price the payer pays is linked to how well the drug actually performs in their patient population. For example, a full rebate might be offered for patients who do not respond to a high-cost oncology drug after a certain period.

Navigating the Payer Gauntlet: Formulary Placement and Prior Authorizations

Securing a favorable position on a payer’s formulary (the list of covered drugs) is the primary goal of the market access team. A drug in a preferred tier means lower out-of-pocket costs for patients and fewer hurdles for physicians. A non-preferred or excluded drug can be a death sentence.

Negotiations with payers are intense and data-driven. The manufacturer presents their clinical and economic value story, while the payer pushes back, armed with their own analyses and the prices of competitor drugs. The outcome of these negotiations determines the level of utilization management that will be applied to your drug. These can include:

- Prior Authorization (PA): The physician must get pre-approval from the insurer before prescribing the drug.

- Step Therapy: The patient must first try and fail on a cheaper, preferred drug before they can “step up” to yours.

Your marketing and patient support programs must be designed to help physicians and patients navigate these hurdles as seamlessly as possible.

Sustaining Momentum: Post-Launch Strategies for Long-Term Dominance

A successful launch is just the beginning. The period from the end of the launch phase until the loss of exclusivity is where a good drug becomes a true blockbuster. This phase is all about Life Cycle Management (LCM). LCM is the strategic process of managing a brand over its entire lifespan to maximize its long-term value. It’s about recognizing that your initial approval is not the final chapter, but the first of many. A brilliant LCM strategy is what allowed a drug like AbbVie’s Humira to generate over $20 billion a year nearly two decades after its initial launch, through a series of new indications and a formidable patent estate [5].

Life Cycle Management (LCM): Extending the Value of Your Asset

LCM is a proactive, forward-looking process that should begin even before the initial launch. It involves a close collaboration between the marketing, clinical, regulatory, and IP teams to identify and execute on opportunities to add value to the brand.

New Indications and Formulations: Expanding the Patient Pool

The most powerful LCM strategy is to expand the number of patients who can benefit from your drug.

- New Indications: This is the gold standard of LCM. It involves conducting new clinical trials to get the drug approved for entirely new diseases. Each new indication is like a mini-launch, requiring its own messaging, data, and regulatory submission. Humira, originally approved for rheumatoid arthritis, ultimately gained approval for more than ten other distinct autoimmune conditions, from Crohn’s disease to psoriasis. Each new indication opened up a vast new market.

- Line Extensions: These are modifications to the existing product.

- New Formulations: Developing a new version of the drug can provide significant clinical and commercial benefits. This could be an extended-release (ER) version that allows for once-daily dosing, a subcutaneous injection to replace an intravenous infusion, or a pediatric formulation for children. These often come with their own new patents, extending the product’s protected life.

- New Delivery Devices: A user-friendly auto-injector pen or a pre-filled syringe can dramatically improve patient convenience and adherence, creating a “stickiness” that is hard for competitors to replicate.

- Combination Products: Combining your drug with another complementary agent into a single pill (a fixed-dose combination) can simplify treatment regimens and create a new, patented entity.

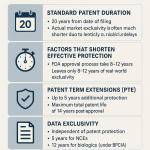

The Pediatric Exclusivity Play (PREA)

Under the Pediatric Research Equity Act (PREA) and the Best Pharmaceuticals for Children Act (BPCA) in the United States, the FDA can request that a company study its drug in pediatric populations. As an incentive for conducting these often difficult and costly studies, the company is granted an additional six months of market exclusivity [6]. This six-month extension applies to all existing patents and exclusivities for the drug, including those for the adult indications. For a blockbuster drug generating billions in annual revenue, this six-month bonus is incredibly valuable and is a cornerstone of LCM planning for nearly every major pharmaceutical product.

Strategic Alliances and Co-promotion Deals

Sometimes, the best way to maximize a drug’s potential is to partner with another company.

- Co-promotion: If your company has a strong presence in a specialty field but the drug also has a large primary care potential, you might partner with a company that has a large primary care sales force to co-promote the drug. This expands your reach far more quickly than you could on your own.

- Geographic Expansion: A U.S.-focused company might partner with a European or Asian company to gain access to their regulatory and commercial infrastructure in those regions.

These alliances allow you to tap into expertise and resources you don’t possess, accelerating growth and maximizing global revenue during the critical on-patent period.

The Power of Real-World Evidence (RWE)

Randomized controlled trials (RCTs) are the gold standard for gaining regulatory approval. However, they are conducted in idealized, highly controlled settings. Payers, physicians, and health systems are increasingly asking: “How does this drug work in the real world, in my complex, diverse patient population?” Real-World Evidence (RWE) is the answer.

From Clinical Trials to Clinical Practice: Proving Value Post-Approval

RWE is health data gathered outside of traditional clinical trials. Sources include:

- Electronic health records (EHRs)

- Insurance claims data

- Patient registries

- Data from wearable devices

By analyzing this data, companies can generate evidence on their drug’s effectiveness, safety, and economic impact in a real-world setting. This evidence is incredibly powerful for marketing and market access teams. An RWE study might show that, in a real-world population, your drug leads to fewer hospitalizations or better adherence than a competitor, even if the head-to-head RCT showed similar efficacy.

Using RWE to Support Payer Negotiations and Guideline Inclusion

RWE is becoming a critical tool in payer negotiations. A robust RWE study that demonstrates value in the payer’s own member population can be far more convincing than the pivotal trial data. It moves the conversation from “What did the trial show?” to “What is the impact for our health system?”

Furthermore, RWE can be instrumental in getting your drug included or upgraded in professional society treatment guidelines. These guidelines are hugely influential on clinical practice. Once a drug is recommended as a first-line or second-line therapy in a major guideline, its place in the treatment algorithm is solidified, creating a durable competitive advantage that can last for years.

Defensive Marketing: Protecting Your Fortress

As your brand becomes successful, it will inevitably attract competition, both from other branded products and, eventually, from generics. Defensive marketing is about protecting your market share from these incursions.

Counter-Detailing Against Competitors

When a new competitor launches, you must be prepared to defend your position. This involves training your sales force and MSL teams to “counter-detail”—to respond to the competitor’s claims with your own data. This requires an intimate knowledge of the competitor’s data, including its weaknesses. Are their trial results applicable to the whole patient population? Did they exclude certain types of patients? What does their safety profile look like? The goal is not to attack the competitor, but to confidently re-establish your own product’s value proposition in light of the new information.

Building Brand Loyalty and Physician Stickiness

The best defense is a deep and enduring loyalty to your brand. This is built over years through:

- Consistent Performance: The drug delivers on its promises for patients.

- Excellent Support: Your patient services programs (e.g., co-pay cards, nurse support) make the drug easy to access and use.

- Trusted Relationships: Your sales reps and MSLs are seen as valuable partners by the physician’s office.

- An Ecosystem of Value: You provide resources beyond the pill, such as patient education materials, practice management tools, and CME programs.

When physicians and patients have a consistently positive experience with your brand over many years, they become reluctant to switch, even when a “similar” competitor or a cheaper generic becomes available. This brand “moat” is one of the most valuable assets you can build.

The Patent Dimension: Actively Managing Your IP for Marketing Supremacy

For many commercial teams, the company’s patent portfolio is a mysterious black box handled by the legal department. This is a massive strategic error. Your intellectual property is not just a legal shield; it is a powerful, proactive marketing tool. Integrating your IP strategy with your marketing strategy can create a formidable competitive advantage, deter rivals, and shape the narrative of your brand’s innovation and durability.

Weaving Your Patent Strategy into Your Marketing Narrative

While you would never lead a sales call by discussing patent numbers, the strength and breadth of your IP portfolio should subtly underpin your entire marketing story. It’s about building a perception of leadership, innovation, and long-term commitment.

Communicating the Strength of Your IP Portfolio (Subtly)

The story you tell KOLs, payers, and even investors should be one of continuous innovation. When you develop a new formulation, a new delivery device, or get a new method-of-use patent, it’s not just a legal filing; it’s a new chapter in your brand’s story. It demonstrates that your company is not resting on its laurels but is continuing to invest in research to improve patient care.

This message of ongoing innovation builds confidence in the brand. It signals to the market that you are the leader in this therapeutic class and that your brand will continue to evolve and improve. This can make potential competitors think twice about entering a space where you are so clearly committed to leading.

Using Patents to Deter “At-Risk” Launches

An “at-risk” launch occurs when a generic company launches its product before all patent litigation has been resolved. They are “at risk” of having to pay substantial damages if the patents are ultimately found to be valid and infringed. A company with a dense, multi-layered “patent thicket”—with patents covering the compound, formulations, methods of use, and manufacturing processes—presents a much more daunting legal challenge.

The stronger and more complex your patent estate, the less likely a generic company is to attempt an at-risk launch. This can effectively add months or even years to your de facto exclusivity period, which is commercially invaluable. Your marketing team should understand the key patents in your portfolio and the timeline of potential challenges, as this directly impacts the long-term forecast and end-of-life strategy.

Leveraging Exclusivities Beyond the Primary Patent

While the main composition of matter (compound) patent is the cornerstone, a savvy company will leverage every possible form of regulatory exclusivity to maximize its protected time on the market. These exclusivities are granted by the FDA for meeting certain criteria and run independently of your patents.

Orphan Drug Exclusivity (ODE): A Powerful Niche Strategy

The Orphan Drug Act provides incentives for developing drugs for rare diseases (affecting fewer than 200,000 people in the U.S.). If a drug is granted “orphan” designation and is subsequently approved for that indication, it receives seven years of market exclusivity for that specific use [7]. This exclusivity prevents the FDA from approving another company’s application for the same drug for the same orphan indication for seven years. ODE is incredibly powerful, especially if the primary patent on the molecule is weak or nearing expiry. It has become a major strategic focus for many companies, allowing them to dominate lucrative niche markets.

New Chemical Entity (NCE) Exclusivity

When the FDA approves a drug containing an active ingredient that has never before been approved, it is designated as a New Chemical Entity (NCE). This designation grants the drug five years of data exclusivity [8]. During this period, the FDA cannot accept a generic application (an Abbreviated New Drug Application, or ANDA) that references the innovator’s data. This provides a baseline level of protection, even before any patent disputes are considered. For drugs with a different active ingredient (not an NCE), such as a new formulation or new indication, a three-year exclusivity is often granted for the new clinical investigations that were required for approval.

Hatch-Waxman and Patent Term Extensions (PTE)

The Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, is the foundational law governing drug patents and generics in the U.S. One of its key provisions allows for Patent Term Extension (PTE). Recognizing that much of a patent’s 20-year term is consumed by the lengthy R&D and regulatory review process, PTE allows a company to restore some of that lost time.

A company can extend the life of one patent (usually the core compound patent) by a period related to the time the drug spent in clinical trials and under FDA review. The extension is capped and cannot extend the total effective patent life beyond 14 years from the approval date [9]. This complex calculation can add anywhere from a few months to a maximum of five years to a patent’s life. From a marketing perspective, securing the maximum possible PTE is a top priority, as every single extra day of monopoly pricing for a blockbuster is worth millions of dollars.

Proactive Patent Defense: More Than Just Litigation

Your IP strategy cannot be passive. You must actively monitor the landscape and be prepared to defend your intellectual property.

Monitoring Generic Filings and Paragraph IV Certifications

When a generic company wants to challenge an innovator’s patent, it files an ANDA with the FDA containing a “Paragraph IV certification.” This is a legal statement asserting that the generic company believes the innovator’s patent is either invalid, unenforceable, or will not be infringed by their generic product [10].

The moment a Paragraph IV certification is filed, a 30-month clock starts ticking. The innovator has 45 days to sue the generic company for patent infringement. If they do, the FDA is automatically barred from approving the generic for 30 months (or until the court case is resolved, whichever comes first).

Marketing and strategic teams must be aware of these filings. Services like DrugPatentWatch are critical here, as they provide timely alerts and detailed information on ANDA filings and Paragraph IV challenges. This is the earliest warning signal of future generic competition and is a critical input for long-range forecasting, competitive response planning, and investor communications.

The Role of Citizen Petitions

A Citizen Petition is a tool that allows any “interested person” (including a pharmaceutical company) to request that the FDA take, or refrain from taking, some form of administrative action. In the context of patent defense, brand-name companies have sometimes filed Citizen Petitions raising scientific or safety questions about the standards for generic approval for their specific drug. While the FDA is required to respond to these petitions, the practice has been controversial, with some critics arguing it is used as a tactic to delay generic entry [11]. Marketers should be aware of this as a potential, albeit complex and highly scrutinized, tool in the late-stage defensive armamentarium.

Navigating the Regulatory and Compliance Minefield

In the highly regulated world of pharmaceuticals, what you can’t say is just as important as what you can say. All marketing and promotional activities are under the watchful eye of the FDA and other global regulatory bodies. A single compliance misstep can lead to warning letters, multi-million dollar fines, and severe damage to the company’s reputation. A successful marketing strategy is always a compliant one.

The FDA’s Watchful Eye: Promotion and Advertising Regulations

In the U.S., the FDA’s Office of Prescription Drug Promotion (OPDP) is the primary enforcement body for drug advertising and promotion. Their mandate is to ensure that promotional materials are truthful, not misleading, and provide a fair balance of risk and benefit information.

On-Label vs. Off-Label Promotion: A Bright Red Line

A pharmaceutical company can only promote its drug for the specific indications, patient populations, and doses that are approved by the FDA and included in the official Prescribing Information, or “label.” Promoting a drug for any other use is known as “off-label” promotion and is strictly prohibited [12].

While physicians are free to prescribe a drug off-label based on their professional judgment, the manufacturer cannot initiate conversations or distribute materials about such uses. This creates a critical distinction between the commercial sales team and the medical MSL team. A sales representative cannot discuss off-label uses. An MSL, in response to an unsolicited request from a physician, can provide truthful, non-promotional scientific information on off-label topics. Adhering to this bright red line is one of the most fundamental rules of compliant pharmaceutical marketing.

Fair Balance: The Yin and Yang of Efficacy and Risk Information

Every time a promotional piece makes a claim about a drug’s efficacy or benefit, it must also include a “fair and balanced” presentation of its risks. In print ads, this is the often lengthy “Important Safety Information.” In TV commercials, it’s the rapidly spoken list of side effects.

Fair balance doesn’t mean equal time or space, but it does mean that the risk information must be presented with a comparable prominence and readability to the benefit information. OPDP scrutinizes materials for things like minimizing risks by putting them in tiny fonts, using distracting visuals during the risk presentation, or overstating efficacy by cherry-picking data from the label. Crafting marketing materials that are both compelling and fully compliant with fair balance requirements is a specialized skill that requires close collaboration between marketing, medical, legal, and regulatory teams.

Global Harmonization vs. Local Adaptation

For global brands, the compliance challenge is magnified. While there is a push for some harmonization, the rules for drug promotion can vary significantly between major markets.

Understanding the Nuances of EMA, PMDA, and other Regulatory Bodies

- The European Medicines Agency (EMA): In Europe, the regulations are often even stricter than in the U.S. Direct-to-consumer (DTC) advertising for prescription drugs is banned in all EU member states. Promotion is strictly limited to HCPs, and the rules are governed by a combination of EU directives and the laws of individual member countries [13].

- Japan’s PMDA: Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) has its own unique set of guidelines for promotion, which are heavily influenced by cultural norms and the structure of the Japanese healthcare system.

- Other Markets: Countries like Canada, Australia, and emerging markets all have their own specific regulations that must be meticulously followed.

Tailoring Marketing Campaigns to Cultural and Medical Practice Differences

A global brand cannot simply translate its U.S. campaign into different languages. The entire strategy must be adapted.

- Cultural Nuances: The imagery, tone, and messaging that resonate in one culture may be ineffective or even inappropriate in another.

- Medical Practice: The standard of care and the role of different types of specialists can vary greatly. Your marketing must reflect the local clinical reality.

- Regulatory Environment: The channels you can use (e.g., DTC, digital) are dictated by local law.

Successful global marketing requires a “glocal” approach: a globally consistent brand strategy that is executed through locally adapted and fully compliant tactics.

The Final Act: Preparing for the Loss of Exclusivity (LOE)

All good things must come to an end. The patent cliff is an unavoidable reality. However, a company that prepares for the Loss of Exclusivity (LOE) years in advance can manage the decline gracefully, extract maximum value from the brand’s “long tail,” and ensure a smooth transition of resources and focus to its next generation of innovative products.

The Authorized Generic (AG) Strategy: Competing with Yourself

One of the most common strategies for managing the LOE is to launch an “authorized generic” (AG). An AG is the exact same drug as the branded product, produced by the brand company (or a partner), but sold as a generic at a generic price [14]. Why would a company compete with itself?

- Capture Generic Revenue: Instead of ceding 100% of the generic market to third-party competitors, the brand company can capture a significant share of that revenue stream through its AG.

- Complicate the Market for Competitors: The presence of an AG on Day 1 of LOE creates immediate price competition for other generic companies, potentially reducing their profit margins and making the market less attractive for them.

- Maintain Manufacturing Volume: It allows the company to maintain production volume at its manufacturing plants, which can be more efficient.

The decision to launch an AG is complex, involving financial modeling and strategic trade-offs, but it has become a standard play in the LOE handbook for many major products.

The Branded-to-Generic Transition: Managing the Decline

In the final 12-24 months before the patent expires, marketing strategy shifts from growth to defense and value extraction.

- Messaging Focus: The message may shift to emphasize the brand’s long history of trusted use, the value of patient support programs (which generics don’t offer), or specific formulations (like an extended-release version) that may have a longer protected life.

- Resource Reallocation: The large sales force and significant promotional budget that supported the brand at its peak will be gradually scaled down. Resources are strategically reallocated to the company’s next launch products.

- Payer Contracts: The company may engage in contracting with payers to try to secure a “preferred brand” status even after generic entry, offering a larger rebate in exchange for the payer making it more difficult for patients to switch to the generic.

The goal is to manage the revenue decline slope, making it as gentle as possible and maximizing the cash flow from the brand’s long tail to fund future innovation.

Building the Next Generation: The Pipeline as Your Ultimate Marketing Tool

Ultimately, the best defense against the patent cliff is a strong and innovative R&D pipeline. A company’s long-term health is not dependent on any single product, but on its ability to consistently bring new, valuable medicines to market.

From a marketing and strategic perspective, the pipeline itself becomes a powerful messaging tool. Communicating the promise of your future pipeline to investors, physicians, and the broader healthcare community demonstrates that your company’s commitment to innovation did not end with your current blockbuster. It builds confidence, maintains scientific leadership, and assures the market that while individual products may face a patent cliff, the company itself is built on a foundation of sustainable innovation. The story of your next breakthrough is the ultimate strategy for moving beyond the end of your last one.

Conclusion: Conducting Your Masterpiece

Marketing a patented drug is one of the most complex and intellectually challenging endeavors in the business world. It is a symphony that requires a conductor—a strategic leader—who can flawlessly integrate the disparate sounds of clinical science, intellectual property law, regulatory compliance, economic value, and human emotion into a single, resonant composition.

It begins not at launch, but years before, with the quiet, foundational work of shaping the market and defining the narrative. It crescendos with a meticulously orchestrated launch that captures the attention of the medical world. It sustains its power through a brilliant second movement of life cycle management, where new indications and formulations extend the brand’s value far beyond its initial conception. And throughout, it is harmonized with a deep understanding of the patent and exclusivity landscape, using IP not just as a shield, but as a sword.

The strategies outlined here are not a simple checklist; they are a mindset. They require a culture of cross-functional collaboration, a relentless focus on the customer, and a long-term vision that looks past quarterly earnings to the full, multi-decade lifespan of an asset. For those who can master this complex art, the rewards are immense: not just commercial success, but the profound satisfaction of ensuring a breakthrough scientific discovery reaches its full potential to improve the lives of patients around the world. Your patent gives you the right to play the game; your marketing strategy determines if you win it.

Key Takeaways

- Marketing is a Force Multiplier for IP: A patent grants exclusivity, but a brilliant marketing strategy is what extracts the maximum value from that exclusivity period. It’s the engine that turns a scientific asset into a commercial blockbuster.

- The Work Begins Years Before Launch: Successful drug marketing starts with “Phase 0” activities like disease state education, KOL engagement, and early payer conversations to prime the market long before FDA approval.

- Integrate Patent Strategy into Marketing: Understand your full patent estate (formulations, methods of use) and leverage all forms of exclusivity (Orphan, NCE, Pediatric). Use services like DrugPatentWatch to monitor competitors and generic challenges, turning IP into a proactive competitive tool.

- Life Cycle Management (LCM) is Key to Long-Term Value: Don’t view your initial approval as the end point. Proactively plan for new indications, formulations, and delivery systems to expand the patient pool and extend the brand’s protected life.

- Value is Defined by the Stakeholder: Your core message must be tailored. Physicians need clinical data, payers need economic evidence (HEOR & RWE), and patients need to understand the tangible quality-of-life benefits.

- Compliance is Non-Negotiable: All promotional activities must adhere to strict regulatory guidelines (e.g., on-label promotion, fair balance). A compliant strategy is the only sustainable strategy.

- Prepare for the Patent Cliff Early: The end of exclusivity is inevitable. Plan your end-of-life strategy—including authorized generics and resource reallocation—years in advance to manage the decline and fund future innovation.

Frequently Asked Questions (FAQ)

1. How early should a commercial/marketing team get involved in the clinical development process?

Ideally, commercial input should be integrated from the very beginning, even at the pre-clinical stage. The marketing team’s most critical early role is to be the voice of the customer (physician, patient, payer) in the development of the Target Product Profile (TPP). By providing input on which clinical endpoints will be most meaningful in the market, how a specific dosing regimen might impact adherence, or what unmet needs exist in specific patient subgroups, they can help shape the clinical trial program to generate data that is not just scientifically sound, but commercially compelling. This prevents the all-too-common scenario of a drug succeeding in its trials but failing to offer a clear, marketable advantage over the existing standard of care.

2. What is the single biggest mistake companies make in their launch strategy?

One of the biggest and most costly mistakes is a failure to fully align the clinical value proposition with the market access strategy. A company might spend years and billions developing a drug with demonstrable clinical benefits, only to launch it with a price and an evidence package that payers are not prepared to accept. This leads to restrictive formularies, burdensome prior authorizations, and frustrated physicians who cannot get the drug for their patients. A slow uptake in the first 6-9 months is incredibly difficult to reverse. The solution is early and continuous engagement with payers to understand their evidence requirements and to build a robust Health Economics and Outcomes Research (HEOR) and Real-World Evidence (RWE) plan that runs parallel to the clinical development program.

3. Our drug is a “fast follower,” not a first-in-class molecule. How should our marketing strategy differ?

For a “fast follower,” the marketing strategy must be laser-focused on differentiation. You don’t have the luxury of defining the market; you are entering a market defined by the first-in-class product. Your entire narrative must answer the question: “Why switch or choose this over the established leader?” This requires a deep analysis of the leader’s weaknesses. Is their tolerability profile suboptimal? Is your dosing more convenient? Did your clinical trial program include a patient population the leader’s did not? Can you compete on access and price? Your marketing must relentlessly hammer on these points of differentiation. It often requires more aggressive comparative messaging (where data and regulations permit) and a highly targeted sales and marketing effort focused on physicians who are either dissatisfied with the leader or have yet to adopt it.

4. How can a smaller biotech with limited resources compete with the marketing power of Big Pharma?

A smaller biotech cannot win by trying to outspend Big Pharma. It must win by being smarter, faster, and more focused. The key is to embrace “niche dominance.” Instead of a broad-based, expensive primary care launch, focus all your resources on a very specific segment of the market where your drug has a clear advantage. This could be a specific patient subtype, a particular specialty of physician, or a defined geographic region. Your marketing should be highly digital and data-driven to efficiently target these key segments. Strategic partnerships are also crucial. Consider co-promotion deals with larger companies to gain sales force muscle, or partner with patient advocacy groups to build grassroots support. The goal is to create a beachhead of loyal users in a core market segment and then expand from that position of strength.

5. With the rise of AI and big data, what is the next frontier in pharmaceutical marketing?

The next frontier is hyper-personalized, predictive engagement. Instead of broad, channel-based strategies, AI will allow companies to develop a predictive “next best action” for engaging with individual physicians. By analyzing vast datasets (prescribing behavior, claims data, digital engagement, publication history), AI models can suggest whether the best next interaction with Dr. Smith is an email with a new clinical paper, a visit from an MSL to discuss a complex case, or an invitation to a peer-to-peer webinar. This allows for an incredibly efficient and tailored allocation of resources. Furthermore, AI will revolutionize the generation of Real-World Evidence, allowing for faster and more sophisticated analyses that can continuously refine and support a drug’s value proposition long after launch.

References

[1] DiMasi, J. A., Grabowski, H. G., & Hansen, R. W. (2016). Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics, 47, 20–33.

[2] Fortune. (2013). The Sinking of a Blockbuster. Retrieved from fortune.com.

[3] U.S. Food and Drug Administration. (2018). Drug and Device Manufacturer Communications With Payors, Formulary Committees, and Similar Entities – Questions and Answers. Retrieved from fda.gov.

[4] IQVIA Institute for Human Data Science. (2023). The Global Use of Medicines 2023: Outlook to 2027. Retrieved from iqvia.com.

[5] Mikulic, M. (2024). AbbVie’s Humira revenue worldwide from 2011 to 2023. Statista. Retrieved from statista.com.

[6] U.S. Food and Drug Administration. (n.d.). Pediatric Exclusivity Provision. Retrieved from fda.gov.

[7] U.S. Food and Drug Administration. (n.d.). Orphan Drug Act. Retrieved from fda.gov.

[8] U.S. Food and Drug Administration. (n.d.). Frequently Asked Questions on Patents and Exclusivity. Retrieved from fda.gov.

[9] U.S. Patent and Trademark Office. (n.d.). Patent Term and Patent Term Adjustment/Extension. Retrieved from uspto.gov.

[10] GIBSON, DUNN & CRUTCHER LLP. (2017). The Hatch-Waxman Act: A Primer. Retrieved from gibsondunn.com.

[11] U.S. Food and Drug Administration. (2020). Citizen Petitions and Petitions for Stay of Action Subject to Section 505(q) of the Federal Food, Drug, and Cosmetic Act; Guidance for Industry. Retrieved from fda.gov.

[12] Kesselheim, A. S., Mello, M. M., & Studdert, D. M. (2011). Strategies and practices in off-label marketing of pharmaceuticals: a retrospective analysis of whistleblower complaints. PLoS Medicine, 8(4), e1000431.

[13] European Parliament and Council. (2001). Directive 2001/83/EC on the Community code relating to medicinal products for human use. Retrieved from EUR-Lex.

[14] U.S. Federal Trade Commission. (2011). Authorized Generics: An Interim Report. Retrieved from ftc.gov.