Part 1: The Precipice – Understanding the Foundations of Patent Expiration

Before we can strategize about navigating the patent cliff, we must first understand the terrain. The landscape of pharmaceutical exclusivity is shaped by a complex interplay of legal statutes, regulatory timelines, and economic realities. This foundational knowledge is not merely academic; it is the bedrock upon which all successful lifecycle management and competitive intelligence strategies are built. Getting this right is the first, and most critical, step toward mastering the post-expiration environment.

The Bedrock of Exclusivity: A Primer on Pharmaceutical Patents

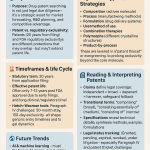

At its core, the pharmaceutical industry’s economic model is built upon a single, indispensable asset: the patent. Patents are not just legal documents; they are the financial engines that fuel the entire innovation ecosystem, providing a temporary monopoly that allows companies to recoup the staggering investments required to bring a new medicine from a laboratory bench to a patient’s bedside.1

Core Concepts and the “Effective” Patent Life

In the United States, a new patent is typically granted for a term of 20 years from the date the application was filed. On the surface, two decades of market exclusivity seems like a generous reward. However, this figure is profoundly misleading. The critical concept that every strategist must grasp is the “effective patent life”—the actual period of market exclusivity a company enjoys after a drug has been approved by the FDA.

The journey from discovery to market is a long and arduous one. Patents are usually filed early in the research and development phase to protect the core invention. What follows is a multi-year gauntlet of preclinical studies, three phases of human clinical trials, and a comprehensive regulatory review by the FDA. This process routinely consumes a massive portion of the 20-year patent term. As a result, the actual period of market exclusivity for most pharmaceuticals is dramatically shorter, typically ranging from just 7 to 12 years.

This chasm between the nominal 20-year term and the 7-to-12-year window of actual market exclusivity is not merely a footnote in pharmaceutical economics; it is the crucible in which nearly every high-stakes commercial strategy is forged. The immense pressure to recoup billions in R&D investment within this compressed timeframe explains the industry’s aggressive launch pricing, its massive marketing expenditures, and its relentless, forward-looking focus on lifecycle management. It forces companies to begin plotting their defense against patent expiration before a drug even receives its first approval, making lifecycle strategy an integral part of the development process itself, not a reactive measure.1

Types of Patents and Regulatory Exclusivities

The shield of exclusivity is not a single wall but a layered defense. The most crucial patent is the “composition of matter” patent, which protects the active pharmaceutical ingredient (API) itself. This is the foundational patent for a new drug. However, innovator companies strategically build upon this foundation by filing for numerous secondary patents, which can cover 3:

- Method of Use: Protecting a novel therapeutic application for the drug (e.g., using an existing drug to treat a new disease).

- Formulation: Protecting a specific formulation, such as an extended-release tablet or a specific combination of ingredients.

- Process (Methods of Manufacture): Protecting a novel and more efficient method for manufacturing the drug.

This practice of layering secondary patents is the basis for the controversial “patent thickets” that we will explore in detail later.

Beyond the patent system, the FDA grants its own forms of market protection known as regulatory exclusivities. These run concurrently with patents and can provide additional protection, sometimes extending exclusivity even after a key patent has expired. Key examples include :

- New Chemical Entity (NCE) Exclusivity: Five years of market exclusivity for a drug containing an active ingredient never before approved by the FDA.

- Orphan Drug Exclusivity (ODE): Seven years of exclusivity for drugs that treat rare diseases affecting fewer than 200,000 people in the U.S.

- Pediatric Exclusivity: An additional six months of exclusivity added to existing patents and exclusivities as a reward for conducting studies in children.

A comprehensive understanding of a drug’s exclusivity landscape requires analyzing both its patent portfolio and its potential regulatory exclusivities. This complex web of protections defines the true timeline a company has to maximize its return on investment and dictates the timing of the patent cliff.

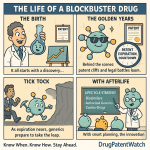

Decoding the “Patent Cliff”: More Than Just a Revenue Drop

If the effective patent life is the source of the pressure, the “patent cliff” is its dramatic release. The term is a colloquialism, but one that aptly captures the phenomenon: a sharp, sudden, and often catastrophic decline in revenue that a company experiences when a blockbuster drug loses patent protection and faces a flood of generic competition.2 It is the moment a high-margin, exclusive product is transformed into a commodity.

The financial impact is staggering. It is not uncommon for a blockbuster drug’s revenue to plummet by 80-90% within the first year of generic entry. For a company heavily reliant on a single product, this is an existential threat. The industry as a whole is perpetually staring down this precipice. Industry analysts project that between 2025 and 2030, nearly 70 high-revenue products will face patent expiration, putting a colossal $236 billion in annual revenue at risk.5 This isn’t a distant threat; it’s a recurring, structural feature of the pharmaceutical market.

Industry Insight

The pharmaceutical industry faces a major patent cliff later this decade, with more than $200 billion in annual revenue at risk through 2030. This looming wave of expirations is forcing companies to aggressively restock their pipelines by investing in R&D, licensing experimental therapies, or acquiring other drugmakers.

The term “patent cliff,” however, can be a misnomer if it implies a single, sudden event. In reality, it is the culmination of a prolonged period of strategic warfare that begins years before the patent expires and continues long after. The “cliff” is the climax, not the beginning of the story. Innovator companies don’t wait passively for this day to arrive; they engage in years of pre-emptive strategies, from building legal fortresses of secondary patents to developing next-generation products.1 Simultaneously, generic companies are not idle; they begin their own development work and file their applications with the FDA years in advance, often initiating patent litigation to challenge the innovator’s exclusivity.13 The period leading up to expiration is therefore a high-stakes chess match. Understanding this “pre-cliff” battle is essential to understanding the final outcome.

This phenomenon is not merely an internal concern for pharmaceutical companies. It has profound implications for investors, who scrutinize a company’s pipeline and patent portfolio for signs of vulnerability. A looming, unaddressed patent cliff can erode investor confidence, depress stock prices, and limit a company’s access to the capital needed for future innovation.1 Consequently, communicating a clear and credible strategy for managing the patent cliff is a critical component of modern investor relations.

To ground this abstract concept in reality, consider the immense financial stakes for some of the industry’s most successful products.

Table 1: The Scale of the Cliff – Key Blockbuster Patent Expirations

| Drug Name (Brand) | Innovator Company | Primary Indication | Peak Annual Sales (USD) | Year of Patent Expiration (U.S.) | Actual/Projected Revenue Impact |

| Lipitor (atorvastatin) | Pfizer | High Cholesterol | ~$13 Billion | 2011 | Sales plummeted by over 50% in the first year; worldwide revenues fell 59% from $9.5B in 2011 to $3.9B in 2012.8 |

| Plavix (clopidogrel) | BMS / Sanofi | Anti-platelet | ~$9 Billion | 2012 | Experienced a significant drop in sales as cheaper generic alternatives became available.7 |

| Humira (adalimumab) | AbbVie | Autoimmune Diseases | ~$21.2 Billion | 2023 (effective) | Sales fell 30.8% in the first nine months of 2023, a less severe drop than anticipated due to defensive strategies.18 |

| Keytruda (pembrolizumab) | Merck | Cancer (Immunotherapy) | ~$29.5 Billion (2023) | 2028 | Sales are projected to decline by 19% in the first year post-expiration, from $33.7B to $27.4B.5 |

| Eliquis (apixaban) | BMS / Pfizer | Blood Thinner | >$10 Billion | ~2026-2028 | Facing a significant patent cliff alongside other major products for Bristol-Myers Squibb. |

This table does more than list numbers; it answers the fundamental question of why companies engage in the complex and costly strategies we are about to discuss. When billions of dollars in annual revenue are on the line, the incentive to defend, extend, and innovate becomes paramount.

Part 2: The New Battlefield – Market Transformation and Competitive Dynamics

When a drug’s patent expires, the market doesn’t just shrink for the innovator; it fundamentally transforms. A monopoly gives way to a dynamic, competitive ecosystem governed by specific legal frameworks and influenced by powerful new players. Understanding this new battlefield—the rules of engagement and the key actors who control the flow of competition—is crucial for both innovators seeking to manage their decline and challengers looking to seize market share.

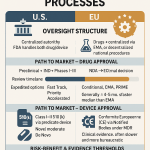

The Generic Wave: How the Hatch-Waxman Act Unleashed Competition

The modern generic drug industry in the United States owes its existence to a single piece of landmark legislation: the Drug Price Competition and Patent Term Restoration Act of 1984, universally known as the Hatch-Waxman Act.13 Before 1984, the path to market for a generic drug was incredibly arduous. A generic manufacturer had to submit a full application package, including its own expensive and time-consuming clinical trials to independently prove safety and effectiveness. This created a formidable barrier to entry, and as a result, generic drugs were a rarity.

Hatch-Waxman revolutionized this landscape by creating the Abbreviated New Drug Application (ANDA) pathway. The genius of the ANDA is that it allows a generic manufacturer to rely on the FDA’s previous finding that the original brand-name drug is safe and effective. Instead of repeating large-scale clinical trials, the generic firm only needs to demonstrate that its product is bioequivalent—that it delivers the same active ingredient to the bloodstream at the same rate and to the same extent as the brand-name drug. This dramatically lowered the cost and time required to bring a generic to market, unleashing a wave of competition.

The Act was a masterfully crafted compromise, designed to balance the competing interests of innovator and generic companies. While it gave generics an easier path to market, it also granted brand-name companies a valuable concession: the ability to apply for patent term extensions to compensate for some of the time their patent was ticking away during the lengthy FDA review process.

The impact of Hatch-Waxman cannot be overstated. It fundamentally rewired the economics of the pharmaceutical industry. In 1984, when the law was enacted, generic drugs accounted for a mere 19% of all prescriptions filled in the U.S. Today, that number has skyrocketed to over 90%. This shift is the single largest driver of cost savings in the American healthcare system, generating hundreds of billions of dollars in savings annually.23

A key strategic element embedded within the Act is the 180-day market exclusivity period granted to the first generic company to file an ANDA containing a “Paragraph IV certification.” This certification is a direct challenge to the innovator’s patents, asserting that they are invalid, unenforceable, or will not be infringed by the generic product. This 180-day exclusivity is a powerful financial incentive that encourages generic firms to take on the risk and expense of patent litigation, thereby accelerating the arrival of competition for blockbuster drugs.12

The Biosimilar Challenge: A More Complex and Costly Arena

While Hatch-Waxman created a superhighway for small-molecule generics, the path for copies of biologic drugs is more like a treacherous mountain road. This is due to the fundamental difference between the molecules themselves.

Small-molecule drugs, like aspirin or atorvastatin (Lipitor), are simple chemical compounds that can be synthesized and replicated perfectly. Biologics, such as monoclonal antibodies like adalimumab (Humira), are vastly larger and more complex proteins produced in living cell systems. To borrow a common industry analogy, if a small-molecule drug is a bicycle, a biologic is a Boeing 787. This complexity means it is scientifically impossible to create an identical copy. Instead, competitors develop “biosimilars”—products that are highly similar to the original biologic, with no clinically meaningful differences in terms of safety, purity, and potency.26

This scientific distinction necessitates a completely different regulatory framework. The Biologics Price Competition and Innovation Act (BPCIA) of 2009 created the abbreviated approval pathway for biosimilars, but it is far more demanding and costly than the ANDA process for generics. Biosimilar development is a massive undertaking, costing between $100 million and $300 million and taking six to nine years. Unlike a generic, a biosimilar applicant cannot simply prove bioequivalence. They must conduct a battery of extensive analytical studies, animal studies, and often at least one human clinical trial to convince the FDA that their product is indeed biosimilar to the reference product.26

The “Patent Dance” and Interchangeability

The legal process is also more complex. The BPCIA introduced a convoluted, multi-step process for resolving patent disputes known as the “patent dance”.30 This is an intricate, and notably optional, series of information exchanges and negotiations between the innovator and the biosimilar applicant to identify which of the innovator’s potentially dozens of patents will be litigated.32 It’s a strategic minefield that can add significant time and legal expense to the process, often delaying market entry.

Furthermore, the BPCIA created a critical two-tiered system for biosimilars: biosimilar and interchangeable. An interchangeable biosimilar has met an even higher regulatory standard, requiring additional clinical studies (called switching studies) to prove that a patient can be switched back and forth between the reference product and the biosimilar with no loss of efficacy or increase in risk. This designation is the holy grail for a biosimilar manufacturer, as it allows a pharmacist to automatically substitute the interchangeable biosimilar for the brand-name biologic at the pharmacy counter, just like a generic.28 Without interchangeability, a physician must specifically write a prescription for the biosimilar by name, a significant barrier to uptake. The high cost and difficulty of achieving interchangeability have severely limited its use and blunted the competitive impact of many biosimilars.

The immense scientific, regulatory, and legal barriers to biosimilar entry have created a market structure that is fundamentally different from the small-molecule world. Because development is so expensive and risky, far fewer competitors can successfully enter the market for a biologic compared to the flood of generics that typically follows a small-molecule patent expiration. This lack of intense, multi-player competition gives incumbent innovators and their partners more leverage to defend their market share, a dynamic that has profound consequences for cost savings and was starkly illustrated by the slow market uptake of Humira’s biosimilars.19

The Gatekeepers: The Pivotal Role of PBMs and Rebate Walls

In the modern U.S. healthcare system, no discussion of drug pricing or market access is complete without understanding the immense power of Pharmacy Benefit Managers (PBMs). These entities are the powerful, and often opaque, intermediaries that sit between drug manufacturers, insurance companies, and pharmacies.36 The three largest PBMs—CVS Caremark, Express Scripts (Cigna), and OptumRx (UnitedHealth Group)—act as gatekeepers, controlling access to prescription drug benefits for the vast majority of Americans.

Their primary function is to manage drug formularies—the tiered lists of medications that an insurance plan will cover—and to negotiate prices with manufacturers on behalf of their clients (insurers and large employers). The central mechanism in this negotiation is the rebate. Brand-name manufacturers pay enormous rebates to PBMs in exchange for securing a favorable position on their formularies, which typically means a lower copay for the patient and fewer restrictions like prior authorization.

This rebate system, however, creates what many critics call a “perverse incentive”.25 Because a PBM’s revenue is often tied to the size of the rebate (which is calculated as a percentage of the drug’s high list price), the PBM may be financially motivated to favor a high-price, high-rebate brand-name drug over a lower-priced generic or biosimilar that offers a smaller rebate, or no rebate at all.35

This dynamic gives rise to one of the most effective defensive strategies an innovator can deploy against a new biosimilar competitor: the “rebate wall”.28 Here’s how it works: the incumbent biologic manufacturer goes to a PBM and offers a substantial rebate on its blockbuster drug. But there’s a catch. The PBM only gets this lucrative rebate if it agrees

not to place the new, competing biosimilar on its formulary, or to place it on a high-cost tier with significant restrictions. The PBM is then faced with a difficult choice: adopt the cheaper biosimilar and lose the massive rebate on the high-volume brand, or keep the brand and its rebate, effectively blocking the competitor. This strategy was a primary reason for the slow initial uptake of Humira biosimilars, as PBMs were locked into favorable rebate deals with AbbVie.34

Shifting Allegiances: The Impact on Physician Prescribing Patterns

Once a drug’s patent expires, where does the physician’s allegiance lie? With the familiar brand they’ve prescribed for years, or with the new, cheaper generic alternative? The answer is more complex than it appears and reveals a crucial strategic lesson.

For small-molecule drugs, the shift to generics is typically swift and decisive. This is less a function of individual physician choice and more a result of powerful systemic forces. State-level automatic substitution laws allow or even mandate that pharmacists dispense a generic equivalent unless the physician explicitly writes “dispense as written”. More importantly, payer formularies and PBMs create strong financial incentives. They place generics on the lowest-cost tiers with minimal copays, while the brand-name drug is often moved to a higher-cost tier or removed from the formulary altogether. For the patient, the choice between a $10 copay for the generic and a $60 copay for the brand is a powerful motivator.

A fascinating and counterintuitive finding from recent research challenges the long-held assumption that pharmaceutical company payments influence this behavior. A rigorous study examining five major drugs that went off-patent found that physicians who received payments from the brand manufacturer transitioned their patients to the generic version just as quickly as physicians who received no such payments. This suggests that at the moment of patent expiry, the systemic incentives for generic substitution are so powerful that they largely override any lingering brand loyalty or influence from marketing payments.

This insight is strategically critical. It implies that in the final years of a drug’s patent life, an innovator’s resources may be better spent securing favorable contracts and rebate agreements with PBMs rather than on direct-to-physician marketing aimed at preserving loyalty post-expiry. The battle shifts from the doctor’s office to the PBM’s boardroom.

The situation is more nuanced for biosimilars. Because most are not interchangeable, the physician must make a conscious, active decision to prescribe the biosimilar by name. Here, factors like brand loyalty, established relationships with the innovator company, and a lack of education or confidence in biosimilars (the “nocebo effect,” where negative expectations lead to perceived adverse effects) can play a much larger role in slowing adoption.26 This gives the innovator’s marketing and educational efforts more traction and makes the biosimilar launch a more challenging uphill climb.

Part 3: The Innovator’s Playbook – Strategic Lifecycle Management

Faced with the inevitability of the patent cliff, innovator companies do not simply wait for the fall. They engage in a sophisticated and multi-faceted discipline known as Product Lifecycle Management (PLM). This is an overarching philosophy that guides a drug’s journey from its earliest development stages through its final years of exclusivity and beyond.6 It is a playbook of both defensive and offensive maneuvers designed to maximize a product’s value, mitigate the financial shock of expiration, and build a bridge to the company’s future. Successful PLM is not last-minute damage control; it is a proactive, long-term strategy woven into the fabric of the company.1

Playing Defense: Pre-emptive Strategies Before the Cliff

The most effective defense against the patent cliff begins years, sometimes even a decade, before a patent is set to expire. Companies that wait until the final hour are destined to face significant disruption. Proactive planning is paramount.

The most fundamental defensive strategy is pipeline replenishment. A company facing the loss of a blockbuster must have new products ready to take its place. This is the lifeblood of the industry. It involves a continuous and massive investment in internal R&D, the strategic in-licensing of promising therapies from smaller biotech firms, and, for larger players, major mergers and acquisitions (M&A) to acquire new revenue streams and pipeline assets.5 Pfizer’s $63 billion acquisition of Allergan, which brought the blockbuster Botox into its portfolio, was a clear move to diversify and shore up revenues ahead of future patent cliffs.

Another critical pre-emptive tactic is product reformulation, often referred to by critics as “product hopping”.5 This strategy involves developing an improved, “next-generation” version of an existing drug and securing new patents on it. This could be an extended-release formulation that offers more convenient once-a-day dosing, a new delivery system like a patch or an inhaler, or a fixed-dose combination with another drug. The goal is to “hop” the market—persuading doctors and patients to switch to the new, patent-protected version

before the original product’s patent expires. If successful, when generics of the original formulation arrive, a significant portion of the market has already moved on, preserving the innovator’s market share. The introduction of Adderall XR just months before the original Adderall’s patent expired is a classic example of this play.

Finally, companies often engage in strategic alliances and joint ventures to share the immense costs and risks of drug development. By co-developing or co-marketing a product, companies can diversify their portfolios and reduce their dependence on a single blockbuster, thereby softening the blow of any one patent expiration.

Extending the Dynasty: The Controversial World of “Evergreening” and “Patent Thickets”

Perhaps the most sophisticated and controversial set of defensive strategies involves leveraging the patent system itself to extend a drug’s effective monopoly. These tactics, known as “evergreening” and “patent thickets,” exist in a gray area between legitimate innovation and anticompetitive maneuvering.

“Evergreening” is the broad term for any strategy used to obtain new patents on an existing product, thereby extending its market exclusivity.1 This is not about extending the original composition of matter patent, which is legally impossible. Instead, it involves securing a series of secondary patents on minor modifications—new formulations, different dosages, new methods of use, or different crystalline forms (polymorphs) of the active ingredient. The practice is incredibly common; one study found that a staggering 78% of drugs associated with new patents between 2005 and 2015 were not novel treatments but existing medications being granted new protections.

A “patent thicket” is a specific and powerful form of evergreening. It is the practice of amassing a dense, overlapping web of dozens or even hundreds of patents around a single product.5 This creates a formidable legal fortress. A potential generic or biosimilar competitor doesn’t just have to challenge one or two key patents; they face the daunting and prohibitively expensive task of litigating a vast portfolio of patents, any one of which could block their market entry.

The legal and ethical debate surrounding these practices is fierce. Critics, including patient advocacy groups and government bodies, argue that evergreening and patent thickets are an abuse of the patent system’s intent.43 They contend that these strategies often rely on trivial modifications that offer little to no additional therapeutic benefit to patients, and serve only to delay the entry of affordable generic competition, keeping drug prices artificially high. The landmark 2013 case in India,

Novartis v. Union of India, is often cited by critics. In this case, the Indian Supreme Court refused to grant a secondary patent for a new crystalline form of the cancer drug Gleevec, ruling that it did not demonstrate enhanced efficacy and was therefore an attempt at evergreening.45

On the other side, pharmaceutical companies and their defenders argue that these secondary patents protect legitimate, incremental innovations that improve patient safety, convenience, or adherence.44 They maintain that even a small change, like creating a chewable tablet for pediatric patients, is a valuable improvement that deserves patent protection. They also argue that these practices are necessary to generate the revenue required to fund the next generation of high-risk, breakthrough R&D. As we will see in the Humira case study, the patent thicket has proven to be one of the most effective defensive weapons in the modern pharmaceutical arsenal.

The Authorized Generic Gambit: Competing with Yourself to Win

One of the most counterintuitive yet powerful strategies in the innovator’s playbook is the launch of an Authorized Generic (AG). An AG is a pharmaceutical product that is identical to the original brand-name drug—same formulation, same manufacturing process—but is marketed without the brand name and at a lower price.48 It is, in essence, the brand company selling its own generic.

What makes the AG such a potent strategic tool is its unique regulatory status. Unlike an independent generic, an AG does not require the submission of an ANDA to the FDA. It is marketed under the brand’s original New Drug Application (NDA).48 This means the brand manufacturer can launch its AG at any time, without the regulatory delays that independent generics often face.

This flexibility gives rise to two primary strategic applications:

- Market Share Recapture: When the first independent generic launches, the brand company can simultaneously launch its own AG. This allows the innovator to directly compete in the generic space and capture a significant portion (often 30-50%) of the market share that would otherwise be lost entirely to the new competitor.14 Pfizer famously used this strategy with Lipitor, partnering with Watson Pharmaceuticals to launch an AG and retain a substantial piece of the revenue pie.

- Generic Entry Deterrence: Perhaps more importantly, the threat of an AG launch can be a powerful deterrent. The 180-day exclusivity period is the grand prize for the first generic filer, a reward for taking on the risks of patent litigation. By launching an AG during this period, the innovator can slash the first filer’s profits, fundamentally altering the economic calculus and making it less attractive for generic firms to challenge patents in the first place.48

This dual nature of AGs makes them a subject of intense debate. Proponents argue that they are pro-competitive, as they introduce an additional competitor into the market immediately, leading to lower prices for consumers than a market with only the brand and a single generic.49 The FTC has found that the presence of an AG during the exclusivity period leads to retail prices that are 4-8% lower.

However, critics contend that this is a short-sighted view. They argue that AGs are a predatory tactic designed to undermine true independent competition. While an AG might lower prices slightly in the short term, its deterrent effect may prevent multiple other generics from ever entering the market. A market with five or six independent generics would see prices fall by 80% or more, far deeper than the modest reduction from a single AG.53 From this perspective, the AG is a sophisticated tool for the innovator to control the pace and depth of price erosion, preventing the market from reaching its most competitive state. The controversial launch of an authorized generic for the EpiPen, at a price point many deemed still too high, is often held up as a prime example of this potential for market manipulation.

From Prescription to Aisle: The Rx-to-OTC Switch Strategy

A final, and increasingly popular, lifecycle management strategy is the prescription-to-over-the-counter (Rx-to-OTC) switch. This involves taking a drug that was once available only by prescription and making it accessible for consumers to purchase directly from pharmacy shelves.9 This can be a powerful way to extend a brand’s life, maintain sales volume, and tap into a new consumer market long after the original patent has expired.

The switch is not automatic; it requires FDA approval. The manufacturer must conduct specific studies, primarily Label Comprehension and Actual Use studies, to prove that an average consumer can correctly diagnose their condition, select the right product, and use it safely and effectively without the guidance of a healthcare professional. If successful, the company is typically granted three years of market exclusivity for the new OTC version, providing a fresh window of protected revenue.

The pharmaceutical landscape is filled with iconic brands that have successfully made this transition, creating entire new categories in the consumer health space. These include:

- Allergy Medications: Claritin (loratadine), Zyrtec (cetirizine), and a wave of nasal sprays like Flonase (fluticasone), Nasonex (mometasone), and Nasacort (triamcinolone).56

- Heartburn Medications: Prilosec (omeprazole) and Nexium (esomeprazole) created the proton pump inhibitor (PPI) category on the OTC aisle.

- Pain Relief: Voltaren Arthritis Pain (diclofenac gel) brought a prescription-strength topical anti-inflammatory directly to consumers.57

- Contraception: The switches of Plan B emergency contraception and, more recently, the Opill daily birth control pill, represent major milestones in expanding access to reproductive health.57

Looking ahead, the FDA’s new “Additional Conditions for Nonprescription Use” (ACNU) rule could dramatically expand the possibilities for Rx-to-OTC switches. This framework could allow more complex drugs, such as statins for cholesterol or certain diabetes medications, to become available over-the-counter, potentially by using a digital tool like a mobile app or a pharmacy kiosk to guide the consumer through a self-selection questionnaire to ensure safe and appropriate use.55 For innovator companies, the Rx-to-OTC switch is no longer a niche tactic; it is a mainstream, high-value strategy for managing the end of a product’s prescription lifecycle.

Part 4: Case Studies in Strategy and Survival

Theory and strategy are one thing; execution in the real world is another. To truly understand the dynamics of the patent cliff, we must examine how these strategies have been deployed in some of the most high-stakes battles in pharmaceutical history. The stories of Lipitor and Humira are not just case studies; they are epic narratives of innovation, defense, and market transformation that offer invaluable lessons for any strategist navigating the post-exclusivity landscape.

The Lipitor Legacy: How Pfizer Fought the Inevitable

In the annals of the pharmaceutical industry, few drugs loom as large as Lipitor (atorvastatin). For years, it was the undisputed king—the best-selling drug in the world, a cash cow that generated peak annual sales of approximately $13 billion and over $125 billion in total revenue for Pfizer.12 Lipitor’s success was so immense that it single-handedly made Pfizer the number one pharmaceutical company in the world for a decade. But as its U.S. patent expiration loomed in November 2011, Pfizer faced a cliff of unprecedented proportions. Its response was a masterclass in fighting a multi-front war to defend every last dollar of revenue.

The Pre-Expiration Playbook

Pfizer’s defense of Lipitor began long before 2011. It was a textbook execution of a pre-emptive lifecycle management strategy :

- Aggressive Marketing and Brand Building: Pfizer understood that in the battle against generics, brand equity was a powerful weapon. The company invested colossal sums in building the Lipitor brand. It deployed a force of over 2,000 sales representatives to educate physicians and spent a staggering $1.43 billion on direct-to-consumer (DTC) advertising between 2000 and 2010, making the Lipitor name a household word.

- Strategic Pricing: Early in its life, Lipitor was priced competitively to unseat the then-market leader, Zocor. Once it achieved dominance, however, Pfizer shifted its strategy, aggressively increasing Lipitor’s price in the years leading up to patent expiration to maximize revenue while it still held its monopoly.

- Legal Delaying Tactics: Pfizer’s legal team was a formidable force, consistently engaging in litigation to fend off generic challengers. The most famous example was its long-running battle with the Indian generic firm Ranbaxy. This ultimately concluded in a 2008 “pay-for-delay” settlement, a controversial but common practice where Pfizer agreed to drop its opposition in exchange for Ranbaxy delaying its generic launch until the managed date of November 2011. This gave Pfizer crucial extra months of blockbuster sales.

- The Failed “Me-Too” Successor: Pfizer’s most ambitious plan was to make Lipitor obsolete itself. It invested heavily in a “me-too” successor drug, torcetrapib, which was designed to not only lower “bad” LDL cholesterol but also raise “good” HDL cholesterol. The hope was to switch the entire market to this new, patent-protected drug before Lipitor’s patent expired. However, the drug spectacularly failed in late-stage clinical trials in 2006 due to safety concerns, forcing Pfizer to abandon its primary succession plan and fall back on its other defensive tactics.

Post-Expiration Warfare

When the patent cliff finally arrived, Pfizer’s strategy shifted from defense to a fierce, hand-to-hand combat for market share :

- The “Lipitor-For-You” Rebate Program: In a bold and unprecedented move, Pfizer went to war on price. It launched the “Lipitor-For-You” program, offering privately insured patients a copay card that allowed them to get brand-name Lipitor for as little as a $4 copayment—often cheaper than the copay for the new generic. Simultaneously, it offered deep rebates to PBMs and insurance plans. This strategy was designed to short-circuit the normal generic substitution process at the pharmacy, preserving brand sales during the crucial first 180 days of generic competition.

- The Authorized Generic Gambit: Pfizer did not cede the generic market entirely. It executed a classic AG strategy, partnering with Watson Pharmaceuticals to launch an authorized generic version of atorvastatin. This allowed Pfizer to retain a reported 70% of the revenue from those sales, effectively competing with itself to keep a larger piece of the overall market pie.

- The Attempted OTC Switch: Recognizing the power of its brand name, Pfizer pursued an Rx-to-OTC switch for a low-dose version of Lipitor. An OTC launch could have generated an estimated $1 billion in new annual sales and provided three more years of market exclusivity. While the FDA ultimately did not approve the switch, it demonstrated Pfizer’s commitment to exploring every possible avenue for lifecycle extension.

- Unrelenting Marketing: Most companies slash marketing budgets to zero once a generic arrives. Pfizer, however, continued to spend heavily on promoting the Lipitor brand even after expiration, spending over $87 million during the first six months of generic competition to fight for every prescription.

In the end, Pfizer could not defy gravity. Lipitor’s sales fell dramatically, and the company lost its top spot in the industry. However, its aggressive and multi-pronged strategy was remarkably successful in softening the blow. Pfizer managed the decline, extracted maximum value from its prized asset, and provided a powerful case study in how to fight a strategic retreat from the patent cliff.

The Humira Fortress: AbbVie’s Masterclass in Modern Biologic Defense

If Lipitor was the defining patent cliff of the small-molecule era, Humira (adalimumab) is its biologic successor, and on an even grander scale. Developed by Abbott and later spun off with AbbVie, Humira became the best-selling drug in history, a colossus treating a range of autoimmune diseases with peak annual sales exceeding $21 billion and cumulative revenues of roughly $200 billion.18 Its loss of exclusivity, which began in the U.S. in 2023, was set to be the steepest patent cliff the industry had ever seen. AbbVie’s defense was a masterclass in leveraging every tool of the modern biologic era to protect its fortress.

The Patent Thicket: A Legal Masterpiece

The centerpiece of AbbVie’s entire defense was the construction of an impenetrable patent thicket. This was not just a handful of secondary patents; it was a legal fortress. AbbVie filed over 300 patent applications and was granted more than 160 patents in the U.S. related to Humira.46 These patents covered everything: not just the primary molecule, but specific manufacturing processes, various formulations, methods of use for different diseases, and even dosing regimens. Nearly 90% of these patents were filed

after Humira was already approved, a clear indication of a deliberate, long-term lifecycle strategy.

This thicket made a direct legal challenge by a biosimilar developer a near-impossible task. The cost, time, and sheer complexity of trying to invalidate over 100 patents were prohibitive. This legal wall was so effective that it allowed AbbVie to maintain its U.S. monopoly for nearly seven years after its main composition of matter patent expired in 2016.20

Strategic Settlements and Product Hopping

Armed with this formidable patent thicket, AbbVie did not need to fight every legal battle to the death. Instead, it used the thicket as a powerful bargaining chip. From a position of strength, AbbVie entered into a series of strategic settlements with potential biosimilar competitors, including major players like Amgen, Sandoz, and Pfizer.46 In these agreements, AbbVie granted the biosimilar manufacturers a license to its patents, allowing them to enter the U.S. market, but only on AbbVie’s terms—a staggered and carefully orchestrated series of launches beginning in January 2023. This allowed AbbVie to control the timing and pace of competition, turning a potential floodgate into a managed trickle.

While the legal strategy was unfolding, AbbVie executed a brilliant commercial maneuver: a “product hop” specifically designed as a “biosimilar defense”. In 2016, AbbVie launched a new formulation of Humira that was high-concentration and, crucially, citrate-free, which made the injection significantly less painful for patients. The company then worked to switch the entire market over to this new, improved, and separately patented version.

The timing was critical. By the time the first biosimilars launched in 2023, most were based on the old, citrate-containing formulation. This meant they were not directly comparable to the version of Humira that most patients were now using. More importantly, it meant they could not achieve interchangeability with the dominant formulation on the market, creating a major barrier to substitution at the pharmacy.38

The Blunted Impact: A “Dismal” Biosimilar Launch

The result of AbbVie’s multi-layered defense was stunning. Despite nine different biosimilars launching in the U.S. throughout 2023, their market uptake was, in the words of one industry group, “dismal”.19 A year after the first biosimilar launch, brand-name Humira still commanded over 96% of the market share.

This was driven by two key factors created by AbbVie’s strategy: the lack of an interchangeable biosimilar for the high-concentration formula, and powerful “rebate wall” agreements with PBMs. PBMs, incentivized by massive rebates from AbbVie, were reluctant to give favorable formulary access to the new biosimilars, often placing them on the same or even a less favorable tier than the brand-name incumbent.34 Humira’s sales certainly declined—falling by about 31% in the first nine months—but this was a far cry from the 80-90% cliff typical of small-molecule drugs. AbbVie’s fortress had held, rewriting the rules for biologic defense in the process.

To appreciate the complexity of the battlefield AbbVie created, it is useful to visualize the array of competitors and their varying attributes.

Table 2: The Humira Biosimilar Landscape (as of 2023-2024)

| Biosimilar Name (Brand) | Manufacturer | U.S. Launch Date | Key Differentiating Feature | Formulation | Interchangeability Status |

| Amjevita (adalimumab-atto) | Amgen | Jan 2023 | First to market; dual pricing (low WAC & high WAC/rebate) | Low Concentration, Citrate-Free | Not Interchangeable |

| Cyltezo (adalimumab-adbm) | Boehringer Ingelheim | Jul 2023 | First to receive interchangeability designation | Low Concentration, Citrate-Containing | Interchangeable (with original Humira) |

| Hyrimoz (adalimumab-adaz) | Sandoz | Jul 2023 | Offered both low WAC and high WAC/rebate versions | High Concentration, Citrate-Free | Not Interchangeable |

| Hadlima (adalimumab-bwwd) | Samsung Bioepis / Organon | Jul 2023 | Available in high-concentration, citrate-free formulation | High Concentration, Citrate-Free | Not Interchangeable (initially) |

| Hulio (adalimumab-fkjp) | Biocon Biologics | Jul 2023 | Offered in both low and high concentration | High Concentration, Citrate-Free | Not Interchangeable |

| Idacio (adalimumab-aacf) | Fresenius Kabi | Jul 2023 | High-concentration, citrate-free formulation | High Concentration, Citrate-Free | Not Interchangeable |

| Yuflyma (adalimumab-aaty) | Celltrion | Jul 2023 | High-concentration, citrate-free formulation | High Concentration, Citrate-Free | Not Interchangeable |

| Yusimry (adalimumab-aqvh) | Coherus BioSciences | Jul 2023 | Launched with a very low WAC to compete on price | High Concentration, Citrate-Free | Not Interchangeable |

| Abrilada (adalimumab-afzb) | Pfizer | Oct 2023 | Available in citrate-free formulations | High Concentration, Citrate-Free | Interchangeable (approved Oct 2023) |

This table clearly illustrates the fragmentation and complexity facing payers and providers. The mix of different concentrations, citrate content, and interchangeability statuses created confusion and inertia, playing directly into AbbVie’s defensive strategy and slowing the erosion of its market dominance.

Part 5: The Path Forward – Data, Innovation, and Future Outlook

As we’ve seen, the patent cliff is not a static event but a dynamic and evolving battlefield. Navigating it successfully requires more than just a good defense; it demands a forward-looking perspective, a deep understanding of the forces shaping the industry, and the right tools to turn information into a decisive advantage. In this final section, we look ahead at the key trends, debates, and technologies that will define the future of post-exclusivity strategy.

Turning Data into Dominance: Leveraging Patent Intelligence

In an environment where a single legal ruling or a competitor’s unexpected move can shift billions of dollars in market value, reactive strategies are a recipe for failure. Proactive, data-driven planning is no longer a luxury; it is a prerequisite for survival. The foundation of this planning is high-quality competitive intelligence (CI), and the most critical source of that intelligence is patent data.3

Patent filings are far more than just legal records. They are a roadmap to the future of the industry. When analyzed systematically, they provide a forward-looking perspective on where innovation is accelerating, where competitors are placing their bets, and where untapped opportunities lie. A robust patent intelligence program allows a company to:

- Conduct Patent Landscape Analysis: Map the entire patent ecosystem for a specific disease or technology to identify emerging trends, potential threats from competitors, and “white spaces”—areas with little or no patent protection that could be ripe for new R&D.3

- Monitor Rivals and Market Shifts: Continuously track the patent filings and litigation activities of competitors to anticipate their next moves, identify potential infringement risks, and make timely adjustments to one’s own strategy.

- Identify Repurposing Opportunities: Sift through patent data to find existing drugs that could be repurposed for new diseases, offering a faster and less risky path to innovation and market exclusivity.

Given the sheer volume and complexity of global patent data, manual analysis is an impossible task. This is where specialized business intelligence platforms become indispensable. Tools like DrugPatentWatch are designed to aggregate, analyze, and translate this complex data into actionable insights for strategic decision-makers.3 A platform like DrugPatentWatch provides a comprehensive, integrated database covering not just patents, but also FDA approvals, clinical trials, patent litigation, and Paragraph IV challenges. It allows business development teams to identify market entry opportunities, portfolio managers to anticipate generic competition and budget accordingly, and wholesalers to prevent being overstocked on a branded drug right before its patent expires.61 By setting up real-time alerts and leveraging sophisticated search capabilities, companies can move from a defensive posture to an offensive one, using data to shape the market to their advantage.

The Innovation Paradox: Does the Patent Cliff Help or Hinder R&D?

One of the most profound and enduring debates in our industry revolves around a central paradox: does the looming threat of the patent cliff ultimately stimulate or stifle true pharmaceutical innovation? The evidence points in both directions, creating a complex strategic landscape for R&D investment.

On one hand, there is a compelling argument that the patent cliff acts as a powerful disincentive for breakthrough research. Some studies have shown that as generic penetration increases in a specific therapeutic area, the number of early-stage and “first-in-class” innovations in that same area tends to decline. Faced with a shorter effective patent life and the certainty of fierce price competition, companies may become more risk-averse. They might shift their R&D resources away from high-risk, novel mechanisms and instead focus on safer bets like incremental “me-too” drugs or evergreening strategies that offer a more predictable, if less innovative, return on investment.47 Furthermore, recent legislation like the Inflation Reduction Act (IRA) in the U.S., with its “pill penalty” that subjects small-molecule drugs to price negotiations sooner than biologics, is seen by many as a further disincentive to invest in the very class of drugs that has historically fueled the generic market.

On the other hand, the patent cliff can be seen as the ultimate catalyst for innovation. For a company facing the loss of a multi-billion-dollar revenue stream, the mandate is simple: innovate or perish.17 This existential pressure forces companies with depleting pipelines to aggressively invest in their R&D engines and pursue the next generation of blockbuster therapies. It pushes the industry towards more complex and scientifically challenging frontiers, such as biologics, cell and gene therapies, and personalized medicine, where the barriers to entry are higher and the potential for long-term exclusivity is greater.64

This “innovation paradox” is creating a strategic bifurcation in the pharmaceutical industry. The patent cliff is simultaneously pushing large, established pharma companies towards high-risk, high-reward biologics and specialty drugs, while also creating a market environment where some of the most reliable short-term returns come from legally complex but scientifically incremental evergreening strategies. A CEO is thus faced with a dual mandate: fund the long-term, high-risk search for the next truly novel blockbuster and fund the legal and development teams to execute short-term, lower-risk lifecycle management strategies on current assets. This tension in resource allocation and strategic focus is shaping the entire R&D landscape of the 21st century.

Finally, we cannot ignore the role of the savings themselves. The generic and biosimilar industry is a massive economic engine for the healthcare system. In 2023 alone, these lower-cost medicines saved the U.S. healthcare system a staggering $445 billion.24 These savings free up enormous resources for patients, employers, and government payers. In a functioning market, these freed-up funds can then be used to pay for new, innovative, and often expensive therapies, thus completing the cycle and providing the commercial incentive for the very R&D that the patent cliff threatens. The health of the generic market and the health of the innovative market are, therefore, inextricably linked.

Conclusion: Navigating the Post-Exclusivity World

The expiration of a drug patent is one of the most powerful and predictable forces in the pharmaceutical industry. It is an inflection point that fundamentally reshapes markets, redefines corporate fortunes, and realigns the interests of every stakeholder in the healthcare ecosystem. As we have explored, this is not a simple event but a complex, multi-year process of strategic maneuvering, legal battles, and commercial adaptation.

For the business professional aiming to turn this challenge into a competitive advantage, the lessons are clear. The era of passive reliance on a single blockbuster’s long tail of revenue is over. Survival and success in the modern pharmaceutical landscape demand a proactive, sophisticated, and data-driven approach to lifecycle management. This journey begins not in the final year of a patent’s life, but on the very first day of a drug’s development.

The strategies employed by companies like Pfizer and AbbVie, while different in their execution, share a common DNA: a deep understanding of the legal and regulatory landscape, a willingness to engage in aggressive and creative commercial tactics, and a relentless focus on maximizing value at every stage of the product lifecycle.

As we look to the future, the battlefield will only become more complex. The rise of biologics, the evolving role of PBMs, and new legislative pressures like the IRA will continue to change the rules of the game. In this environment, the ability to anticipate market shifts, decode competitor strategies, and identify new opportunities will be the ultimate differentiator. The companies that thrive will be those that view the patent cliff not as an end, but as a transition—and that leverage powerful intelligence tools, like those offered by DrugPatentWatch, to navigate that transition with foresight, agility, and precision. The end of exclusivity is inevitable, but for the prepared, it is also a new beginning.

Key Takeaways

- The Patent Cliff is a Culmination, Not an Event: The dramatic revenue drop upon patent expiration is the result of a multi-year strategic battle between innovators and challengers. Proactive planning that begins early in a drug’s lifecycle is essential.

- Financial Impact is Severe but Manageable: Innovator revenues can decline by 80-90%, with over $200 billion at risk industry-wide by 2030. However, strategies like launching authorized generics, product hopping, and Rx-to-OTC switches can significantly soften the blow.

- Generics and Biosimilars are Fundamentally Different Battlefields: The Hatch-Waxman Act created a clear path for small-molecule generics, leading to rapid price erosion and market share loss for innovators. The BPCIA pathway for biologics is far more complex and costly, resulting in fewer competitors and giving innovators more leverage to defend their franchises through tactics like “rebate walls.”

- PBMs are the New Gatekeepers: Especially in the biologics space, the battle for market share has shifted from influencing individual physicians to securing favorable formulary placement with powerful Pharmacy Benefit Managers (PBMs). Their rebate-driven business model is a key factor in the slow uptake of many biosimilars.

- Lifecycle Management is a Multi-Pronged Strategy: There is no single silver bullet. A successful defense combines pipeline replenishment, strategic legal tactics like building patent thickets, commercial maneuvers like product hopping, and post-expiration plays like authorized generics and OTC switches.

- Patent Data is Actionable Competitive Intelligence: In this high-stakes environment, leveraging specialized platforms like DrugPatentWatch to monitor patent expirations, litigation, and competitor pipelines is no longer optional. It is a critical tool for turning data into a decisive strategic advantage.

- The Innovation Paradox Shapes R&D: The patent cliff creates a dual pressure on R&D: it forces investment in high-risk, breakthrough therapies to replace lost revenue while simultaneously incentivizing lower-risk, incremental evergreening strategies to protect current assets.

Frequently Asked Questions (FAQ)

1. What is the “generic paradox” and why does it occur?

The “generic paradox” refers to the observed phenomenon where the price of the brand-name drug sometimes increases after the entry of the first generic competitors. This seems counterintuitive, as competition should drive prices down. The primary explanation lies in market segmentation. When generics enter, they quickly capture the most price-sensitive portion of the market (patients and payers who will switch for any cost savings). The remaining pool of patients who continue to use the brand-name drug are often less price-sensitive or have what is called “brand loyalty.” The brand manufacturer, having lost the price-sensitive segment, may then raise the price for this remaining “loyal” segment to maximize revenue from a smaller but more dedicated customer base.

2. Why has biosimilar uptake been so much slower in the U.S. compared to Europe?

There are several key reasons for this disparity. First, the U.S. regulatory pathway is more complex, particularly the high bar for achieving “interchangeability,” which allows for automatic pharmacy substitution.28 Without it, physicians must actively prescribe the biosimilar. Second, the U.S. healthcare system is dominated by PBMs and a rebate system that can create “perverse incentives.” Incumbent biologic manufacturers can offer massive rebates to PBMs to create “rebate walls” that effectively block biosimilar access to formularies, a practice less prevalent in Europe’s single-payer or government-negotiated systems.28 Finally, U.S. law allows for the creation of extensive “patent thickets,” which innovators like AbbVie have used to delay biosimilar entry through litigation and strategic settlements for years longer than was possible in Europe.46

3. Are “patent thickets” and “evergreening” illegal?

This is a highly contentious issue. Currently, there is no specific U.S. law that makes these practices illegal per se.44 Defenders argue that each patent within a thicket has been individually examined and approved by the U.S. Patent and Trademark Office (PTO) as a legitimate, novel, and non-obvious invention. They contend they are simply protecting their intellectual property as the law allows. Critics, however, argue that while individual patents may be technically legal, the

strategy of accumulating hundreds of them to create an anticompetitive barrier violates the spirit of patent law and potentially antitrust laws. Courts have so far been reluctant to declare the practice of building a patent thicket as an antitrust violation on its own, as seen in the Humira case, but the legal and legislative scrutiny of these practices is intensifying.

4. How does the Inflation Reduction Act (IRA) change the strategic calculations around patent cliffs?

The IRA introduces a major new variable: government price negotiation for certain high-spend drugs in Medicare. This fundamentally alters the landscape. For one, it lowers the “peak” from which a drug will fall off the patent cliff. If a drug’s price is already negotiated down by Medicare before its patent expires, the revenue loss upon generic entry will be less dramatic, but the total revenue earned during its exclusive life will also be lower.25 More importantly, it weakens the incentive for generics to enter the market. Generics are most attracted to high-price, high-volume drugs. If the government has already forced the brand’s price down, the potential profit margin for a generic is squeezed, potentially leading to fewer generic challengers and less competition in the long run.25 As one executive noted, companies are now building IRA impact directly into their R&D and business development valuation models from the very earliest stages.

5. For a smaller biotech company with one main asset, what is the single most important strategy to prepare for patent expiration?

For a smaller, single-asset biotech, the most critical strategy is strategic partnering or acquisition well before the patent cliff. Unlike a large pharmaceutical company that can rely on a diverse pipeline to absorb the revenue loss, a single-asset company has no internal buffer. Its entire value is tied to that one product. Therefore, its lifecycle strategy must focus on making the asset as attractive as possible to a larger partner or acquirer. This involves not just maximizing sales during the exclusivity period, but also building a strategic moat around the product. This could include developing and patenting a next-generation formulation, securing orphan drug designation for a niche indication, or developing a robust patent thicket (to the extent possible). These actions increase the asset’s value and extend its potential revenue-generating life, making it a more valuable target for a larger company like Pfizer or Merck, who can then integrate it into their broader portfolio and manage the eventual patent expiration. The goal is not to survive the cliff alone, but to use the pre-expiration years to secure a successful exit.

References

- The Impact of Patent Expirations on SEC Filings and Investor Relations – PatentPC, accessed July 28, 2025, https://patentpc.com/blog/the-impact-of-patent-expirations-on-sec-filings-and-investor-relations

- Patent Cliff: What It Means, How It Works – Investopedia, accessed July 28, 2025, https://www.investopedia.com/terms/p/patent-cliff.asp

- Best Practices for Drug Patent Portfolio Management: Leveraging …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/best-practices-for-drug-patent-portfolio-management-2/

- Patent Valuation in the Pharmaceutical Industry: Key Considerations – PatentPC, accessed July 28, 2025, https://patentpc.com/blog/patent-valuation-in-the-pharmaceutical-industry-key-considerations

- What Happens When a Drug Patent Expires? Understanding Drug Patent Life, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/what-happens-when-a-drug-patent-expires/

- Ultimate Guide to Pharmaceutical Product Life Cycle Management (PLM) – TikaMobile, accessed July 28, 2025, https://www.tikamobile.com/resources/blog/ultimate-guide-to-pharmaceutical-product-life-cycle-management

- Patent cliff – Wikipedia, accessed July 28, 2025, https://en.wikipedia.org/wiki/Patent_cliff

- What is a patent cliff, and how does it impact companies? – Patsnap Synapse, accessed July 28, 2025, https://synapse.patsnap.com/article/what-is-a-patent-cliff-and-how-does-it-impact-companies

- The Impact of Drug Patent Expiration: Financial Implications, Lifecycle Strategies, and Market Transformations – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-drug-patent-expiration-financial-implications-lifecycle-strategies-and-market-transformations/

- 5 Steps to Take When Your Drug Patent is About to Expire, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/5-steps-to-take-when-your-drug-patent-is-about-to-expire/

- What are Patent Cliffs and How Pharma Giants Face Them in 2024, accessed July 28, 2025, https://www.patentrenewal.com/post/patent-cliffs-explained-pharmas-strategies-for-2024-losses

- (PDF) Managing the challenges of pharmaceutical patent expiry: a …, accessed July 28, 2025, https://www.researchgate.net/publication/309540780_Managing_the_challenges_of_pharmaceutical_patent_expiry_a_case_study_of_Lipitor

- 40th Anniversary of the Generic Drug Approval Pathway | FDA, accessed July 28, 2025, https://www.fda.gov/drugs/cder-conversations/40th-anniversary-generic-drug-approval-pathway

- Competing in the Generic Drug Market: Strategies for Success …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/competing-in-the-generic-drug-market-strategies-for-success/

- Understanding the Financial Implications of Patent Expirations – Qualifyze, accessed July 28, 2025, https://www.qualifyze.com/resources/understanding-the-financial-implications-of-patent-expirations/

- Lipitor Patent Expires | The Scientist, accessed July 28, 2025, https://www.the-scientist.com/lipitor-patent-expires-41658

- Patent Expiration Dates And Challenges To Generic Drug Entry – FasterCapital, accessed July 28, 2025, https://fastercapital.com/topics/patent-expiration-dates-and-challenges-to-generic-drug-entry.html

- 5 Pharma Powerhouses Facing Massive Patent Cliffs—And What They’re Doing About It, accessed July 28, 2025, https://www.biospace.com/business/5-pharma-powerhouses-facing-massive-patent-cliffs-and-what-theyre-doing-about-it

- After a year on the market, Humira biosimilars aren’t making much of a dent, accessed July 28, 2025, https://www.healthcare-brew.com/stories/2024/01/29/after-a-year-on-the-market-humira-biosimilars-aren-t-making-much-of-a-dent

- Two decades and $200 billion: AbbVie’s Humira monopoly nears its …, accessed July 28, 2025, https://www.biopharmadive.com/news/humira-abbvie-biosimilar-competition-monopoly/620516/

- www.fda.gov, accessed July 28, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/hatch-waxman-letters#:~:text=The%20%22Drug%20Price%20Competition%20and,Drug%2C%20and%20Cosmetic%20Act%20(FD%26C

- Hatch-Waxman Act – Practical Law, accessed July 28, 2025, https://uk.practicallaw.thomsonreuters.com/Glossary/PracticalLaw/I2e45aeaf642211e38578f7ccc38dcbee

- Report: 2022 U.S. Generic and Biosimilar Medicines Savings Report, accessed July 28, 2025, https://accessiblemeds.org/resources/reports/2022-savings-report/

- 2024 U.S. Generic & Biosimilar Medicines Savings Report …, accessed July 28, 2025, https://accessiblemeds.org/resources/reports/2024-savings-report/

- How the IRA is impacting the generic drug market – PhRMA, accessed July 28, 2025, https://phrma.org/blog/how-the-ira-is-impacting-the-generic-drug-market

- Challenges of Integrating Biosimilars Into Clinical Practice – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7857316/

- Biosimilars are Overcoming Challenges of a Turbulent, Unfriendly Marketplace – ACCC Cancer, accessed July 28, 2025, https://www.accc-cancer.org/docs/documents/oncology-issues/articles/2021/v36-n6/v36n6-issues.pdf?sfvrsn=e62b46fd_8&

- Understanding the Barriers to US Biosimilars: Navigating …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/understanding-barriers-us-biosimilars/

- Three imperatives for R&D in biosimilars – McKinsey, accessed July 28, 2025, https://www.mckinsey.com/industries/life-sciences/our-insights/three-imperatives-for-r-and-d-in-biosimilars

- What Is the Patent Dance? | Winston & Strawn Law Glossary …, accessed July 28, 2025, https://www.winston.com/en/legal-glossary/patent-dance

- www.winston.com, accessed July 28, 2025, https://www.winston.com/en/legal-glossary/patent-dance#:~:text=Colloquially%20referred%20to%20as%20the,information%20disclosed%20in%20the%20aBLA.

- Five key questions about the ‘patent dance’ answered – Generics and Biosimilars Initiative, accessed July 28, 2025, https://gabionline.net/policies-legislation/Five-key-questions-about-the-patent-dance-answered

- How Biosimilars Are Approved and Litigated: Patent Dance Timeline – Fish & Richardson, accessed July 28, 2025, https://www.fr.com/insights/ip-law-essentials/how-biosimilars-approved-litigated-patent-dance-timeline/

- Four Challenges Impacting Biosimilar Savings, accessed July 28, 2025, https://innovativerxstrategies.com/4-challenges-biosimilar-savings/

- Adalimumab Biosimilar Tracking, accessed July 28, 2025, https://biosimilarscouncil.org/wp-content/uploads/2024/04/04022024_IQVIA-Humira-Tracking-Executive-Summary.pdf

- PBM Regulations on Drug Spending | Commonwealth Fund, accessed July 28, 2025, https://www.commonwealthfund.org/publications/explainer/2025/mar/what-pharmacy-benefit-managers-do-how-they-contribute-drug-spending

- 5 Things To Know About Pharmacy Benefit Managers – Center for American Progress, accessed July 28, 2025, https://www.americanprogress.org/article/5-things-to-know-about-pharmacy-benefit-managers/

- Will the Entry of Adalimumab Biosimilars to the US Market Successfully Lower Spending?, accessed July 28, 2025, https://www.centerforbiosimilars.com/view/will-the-entry-of-adalimumab-biosimilars-to-the-us-market-successfully-lower-spending-

- Realizing the Benefits of Biosimilars: Overcoming Rebate Walls – Duke-Margolis Institute for Health Policy, accessed July 28, 2025, https://healthpolicy.duke.edu/sites/default/files/2022-03/Biosimilars%20-%20Overcoming%20Rebate%20Walls.pdf

- Drug Firms’ Payments and Physicians’ Prescribing Behavior in …, accessed July 28, 2025, https://www.nber.org/system/files/working_papers/w26751/w26751.pdf

- Increasing access to lifesaving treatments: How Humira® biosimilars will reshape the healthcare industry – Cardinal Health Newsroom, accessed July 28, 2025, https://newsroom.cardinalhealth.com/2023-08-21-Increasing-access-to-lifesaving-treatments-How-Humira-R-biosimilars-will-reshape-the-healthcare-industry

- Life Cycle Management Pharma | AspenTech, accessed July 28, 2025, https://www.aspentech.com/en/cp/life-cycle-management-pharma

- Does Drug Patent Evergreening Prevent Generic Entry …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/does-drug-patent-evergreening-prevent-generic-entry/

- The Role of Patents and Regulatory Exclusivities in Drug Pricing …, accessed July 28, 2025, https://www.congress.gov/crs-product/R46679

- Patent Evergreening In The Pharmaceutical Industry: Legal …, accessed July 28, 2025, https://ijlsss.com/patent-evergreening-in-the-pharmaceutical-industry-legal-loophole-or-strategic-innovation/

- AbbVie’s successful hard-ball with Humira legal strategy unlikely to …, accessed July 28, 2025, https://www.pharmaceutical-technology.com/comment/abbvies-successful-hard-ball-with-humira/

- Drug patents: the evergreening problem – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC3680578/

- Entry Delays and Fighting Brands: Evidence from … – GitHub Pages, accessed July 28, 2025, https://rubaiyat-alam.github.io/website/pharma_ag_rubaiyat_conti.pdf

- Understanding the Impact of Authorized Generics on Drug Pricing: A …, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/understanding-the-impact-of-authorized-generics-on-drug-pricing-the-entacapone-case-study/

- Market dynamics of authorized generics in Medicaid from 2014 to 2020 – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC10315369/

- Antitrust and Authorized Generics – Stanford Law Review, accessed July 28, 2025, https://review.law.stanford.edu/wp-content/uploads/sites/3/2020/03/Peelish-72-Stan.-L.-Rev.-791.pdf

- Authorized Generics, Competition, and Consumer Prices – Analysis Group, accessed July 28, 2025, https://www.analysisgroup.com/Insights/cases/authorized-generics-competition-and-consumer-prices/

- Patent Expiration and Pharmaceutical Prices | NBER, accessed July 28, 2025, https://www.nber.org/digest/sep14/patent-expiration-and-pharmaceutical-prices

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices – HHS ASPE, accessed July 28, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- The Commercial Potential – and Practical Challenges – of Marketing OTC Drugs With ‘Additional Conditions for Nonprescription Use’ | Insights – Skadden, accessed July 28, 2025, https://www.skadden.com/insights/publications/2025/01/the-commercial-potential

- A Look At FDA’s Plans To Establish New OTC Drug Category – Skadden, accessed July 28, 2025, https://www.skadden.com/-/media/files/publications/2025/01/a_look_at_fdas_plans_to_establish_new_otc_drug_category.pdf?rev=d42c2b192d3544eead3d6e3532b7d84e

- Rx to OTC: 5 drugs that went from prescription to over-the-counter – Maxor, accessed July 28, 2025, https://www.maxor.com/rx-to-otc/

- Rx-to-OTC Switches: How it Works and Popular Examples – GoodRx, accessed July 28, 2025, https://www.goodrx.com/drugs/otc/switch-from-rx

- Prescription to Nonprescription Switch List – FDA, accessed July 28, 2025, https://www.fda.gov/about-fda/center-drug-evaluation-and-research-cder/prescription-nonprescription-switch-list

- How AbbVie denied Americans access to fair competition for Humira, accessed July 28, 2025, https://qz.com/humira-abbvie-competition-from-cheaper-biosimilars-1849876888

- DrugPatentWatch | Software Reviews & Alternatives – Crozdesk, accessed July 28, 2025, https://crozdesk.com/software/drugpatentwatch

- Find Your Next Blockbuster – Biotech & Pharmaceutical patents, sales, drug prices, litigation – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/about.php

- DrugPatentWatch 2025 Company Profile: Valuation, Funding & Investors | PitchBook, accessed July 28, 2025, https://pitchbook.com/profiles/company/519079-87

- Journal of Chemical Health Risks Patent Cliffs: What Happens When a Drug Patent Expires?, accessed July 28, 2025, https://jchr.org/index.php/JCHR/article/download/8398/4800/15877

- How Generic Drugs, Patents, and Price Controls Affect Markets | NBER, accessed July 28, 2025, https://www.nber.org/digest/jan15/how-generic-drugs-patents-and-price-controls-affect-markets

- AAM Report: Generics and Biosimilars Savings Reach $445 Billion in 2023, Part 1, accessed July 28, 2025, https://www.centerforbiosimilars.com/view/aam-report-generics-and-biosimilars-savings-reach-445-billion-in-2023-part-1

- Report Highlights Biosimilars Savings, but High Out-of-Pocket Costs for Patients, accessed July 28, 2025, https://www.ajmc.com/view/report-highlights-biosimilars-savings-but-high-out-of-pocket-costs-for-patients

- The Impact of Patent Expiry on Drug Prices – DrugPatentWatch, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/the-impact-of-patent-expiry-on-drug-prices-a-systematic-literature-review/

- Potential Impact of the IRA on the Generic Drug Market – Lumanity, accessed July 28, 2025, https://lumanity.com/perspectives/potential-impact-of-the-ira-on-the-generic-drug-market/

- IRA: How Pharma Executives Are Responding – AlphaSense, accessed July 28, 2025, https://www.alpha-sense.com/blog/trends/inflation-reduction-act-executive-response/

- Complete Pharma Product Lifecycle Guide: Discovery to Market, accessed July 28, 2025, https://synergbiopharma.com/pharma-product-lifecycle/

- Generic entry in the pharmaceutical market: why less is better. – CRESSE, accessed July 28, 2025, https://www.cresse.info/wp-content/uploads/2020/02/2018_ps4_pa3_Generic-entry.pdf

- When does the patent for Atorvastatin expire? – Patsnap Synapse, accessed July 28, 2025, https://synapse.patsnap.com/article/when-does-the-patent-for-atorvastatin-expire

- The 3 Things That Matter for AbbVie Now | The Motley Fool, accessed July 28, 2025, https://www.fool.com/investing/2025/07/24/the-3-things-that-matter-for-abbvie-now/

- ABBV: Can AbbVie Overcome the Humira Patent Cliff and Drive Future Growth? – YouTube, accessed July 28, 2025, https://www.youtube.com/watch?v=LYp8TfLaVlc

- Breaking Down Barriers: Why Biosimilars Face Resistance in the US Market – HCPLive, accessed July 28, 2025, https://www.hcplive.com/view/breaking-down-barriers-why-biosimilars-face-resistance-us-market

- Requiring Humira Biosimilars Results in Huge Savings for Navitus Clients, accessed July 28, 2025, https://www.managedhealthcareexecutive.com/view/requiring-humira-biosimilars-results-in-huge-savings-for-navitus-clients

- Most Medicare Part D Plans’ Formularies Included Humira Biosimilars for 2025, accessed July 28, 2025, https://oig.hhs.gov/reports/all/2025/most-medicare-part-d-plans-formularies-included-humira-biosimilars-for-2025/

- Biosimilars and Their Impact on Humira’s Market Share – Serve You Rx, accessed July 28, 2025, https://serveyourx.com/news-blog/biosimilars-and-their-impact-on-humiras-market-share/

- The Expiry of Humira® Market Exclusivity and the Entry of Adalimumab Biosimilars in Europe: An Overview of Pricing and National Policy Measures, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7839249/

- Drug Patents, Exclusivity & Lessons from Humira: A Biosimilars Boom | Contract Pharma, accessed July 28, 2025, https://www.contractpharma.com/exclusives/drug-patents-exclusivity-lessons-from-humira-a-biosimilars-boom/

- Strategies that delay or prevent the timely availability of affordable generic drugs in the United States, accessed July 28, 2025, https://ashpublications.org/blood/article/127/11/1398/34989/Strategies-that-delay-or-prevent-the-timely

- The Importance of International R&D Collaborations in Generic Drug Development, accessed July 28, 2025, https://www.drugpatentwatch.com/blog/the-importance-of-international-rd-collaborations-in-generic-drug-development/

- The Patent Cliff: From Threat to Competitive Advantage – Esko, accessed July 28, 2025, https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage

- Patent Database Exposes Pharma’s Pricey “Evergreen” Strategy – UC Law San Francisco, accessed July 28, 2025, https://www.uclawsf.edu/2020/09/24/patent-drug-database/

- The impact of an ‘evergreening’strategy nearing patent expiration on …, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11377641/

- Prescribing Behavior of General Practitioners for Generic Drugs – MDPI, accessed July 28, 2025, https://www.mdpi.com/1660-4601/17/16/5919

- 2024 U.S. Generic & Biosimilar Medicines Savings Report, accessed July 28, 2025, https://biosimilarscouncil.org/resource/2024-us-generic-biosimilar-savings-report/

- Generic Drugs: A Treatment for High-Cost Health Care – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC7023936/

- Listening Session: Anticompetitive Conduct by Pharmaceutical Companies Impeding Generic or Biosimilar Competition | Federal Trade Commission, accessed July 28, 2025, https://www.ftc.gov/news-events/events/2025/06/listening-session-anticompetitive-conduct-pharmaceutical-companies-impeding-generic-or-biosimilar

- How to compete and win in a world with biosimilars – KPMG agentic corporate services, accessed July 28, 2025, https://assets.kpmg.com/content/dam/kpmg/pdf/2015/10/world-of-biosimilars.pdf

- Report: 2023 U.S. Generic and Biosimilar Medicines Savings Report …, accessed July 28, 2025, https://accessiblemeds.org/resources/reports/2023-savings-report-2/

- 2023 U.S. Generic and Biosimilar Savings Report: Biosimilars Deliver on Their Promise, accessed July 28, 2025, https://biosimilarscouncil.org/resource/2023-us-generic-biosimilar-savings-report/

- Biosimilar Cost Savings in the United States: Initial Experience and Future Potential – PMC, accessed July 28, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC6075809/

- Data Snapshot: Biosimilar Cost and Use Trends in Medicare Part B, accessed July 28, 2025, https://oig.hhs.gov/reports/all/2024/data-snapshot-biosimilar-cost-and-use-trends-in-medicare-part-b/

- accessed December 31, 1969, httpshttps://lumanity.com/perspectives/potential-impact-of-the-ira-on-the-generic-drug-market/